Financial Planning: How to Pay off Debt Fast with Low Income?

If you’re like many Americans, you’re experiencing mounting debt (perhaps already drowning in it, even) and scrambling to figure out how to pay off debt fast with low income. Failing to pay off your debt only causes it to increase while, at the same time, your credit score decreases. In the most extreme of cases, insurmountable debt can lead to defaults, repossessions, evictions, foreclosures and, even, bankruptcy.

Failing to pay it off fast only causes that compounding of the debt to accelerate, so that, even if you do eventually pay it off, you’re paying far more for that original debt than you needed to or, likely, ever considered spending for it.

Fortunately, "you’re not alone" is not the only comfort you can take.

You can also take comfort in the fact that tools, resources and simple tips exist—many, in fact—that can help you pay off debt fast with low income.

In this article, you’ll discover many of the simplest and most effective of these tools, resources and tips for getting out of debt as fast as you can, even with very little means with which to do so.

Read on to find the hope and empowerment you need to move forward in life free of debt.

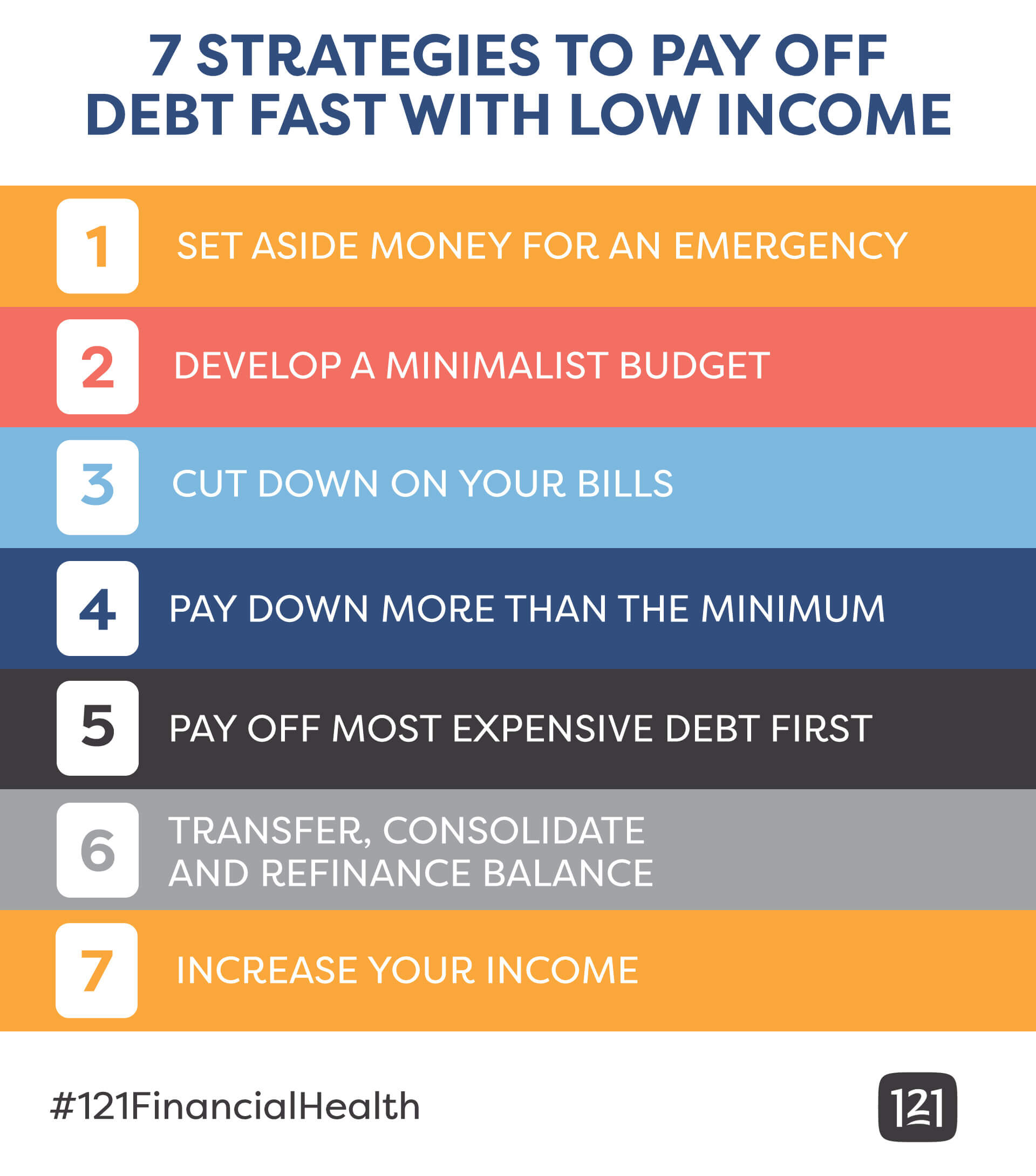

Low-income Debt-relief Strategies

As you review the following strategies for getting out of debt with low income, look for the one or ones that seem easiest to accomplish, and start with those.

Once you feel comfortable having implemented those strategies, incorporate one or two more.

The more of these strategies you are able to employ at once, the faster you can see your debt diminish and, ultimately, disappear.

Set Aside money for an Emergency Fund

It may seem antithetical to getting out of debt to set aside money for other purposes than paying down debt, but, in fact, in at least one case, it can actually help you get out of debt even faster.

Consider this: how did you get into debt in the first place? Some people (or even all or most people at some times) use debt to live outside their means.

For low-income individuals and families, however, debt is often the result of paying for those unplanned-for expenses that come up unexpectedly.

Now ask yourself: How much would an emergency fund have helped during those times you ended up needing to use debt to handle a sudden expense?

Another way of looking at it is like this: One of the biggest and fastest deterrents of your debt-repayment plans is these emergency expenses.

Set aside a small amount of your income each week into a fund you commit to only touching in cases of absolute, sudden, urgent emergency.

Keep this fund in a separate account, so that you’re not compelled to dip into it whenever you access your regular checking or savings account.

Develop a Minimalist Budget

The next step to reducing your debt as fast as you can when you have little income to work with is to reign in your spending. Specifically, determine how much of your spending is on actual needs and how much is spent otherwise.

How much will it cost you per month to pay only for what you need?

To figure this out, write down all your necessary monthly expenses. These can include:

- Rent or mortgage

- Car note

- Phone

- Internet

- Food

- Electricity bill

This is your minimalist (or minimal-needs) budget. From here, you can now look at your monthly income through the lens of this budget and see how much of your income is left to help you pay down your debt faster.

One helpful strategy for devising a minimal-needs budget is the zero-sum budget, in which you start with a predetermined amount of money (specifically, your actual income from the previous month) and work backwards, subtracting all your necessary expenses until you run out of expenses or money.

This can give you a stark view of your current financial situation, that you can then, tweak, to fit your new debt-repayment objectives.

Cut Down on Your Bills

Next is to look at possible ways to make these necessary expenses even lower, for they might be essential expenses, but that doesn’t mean they have to cost as much as they do.

- Grocery bill - Look at ways you can cut down on your grocery bills, such as by clipping coupons, or switching from brand-name products to store brands.

- Electricity bill - Find ways to cut down on your electricity bill, such as by setting aside one night per week as TV-free, or setting your lights and climate controls on timers, so they’re not running while you’re asleep or away from home.

- Phone bill - See if you can lower your phone bill by eliminating features you don’t use or scaling back storage or memory capacities you don’t need.

- Other expenses - See if you can lower your health, home and auto insurance costs by picking higher-deductible plans. Can you cut down on housing costs by taking on a roommate or renting out a little-used part of your home? Can you cut down on gasoline costs by starting a rideshare program with some of your coworkers?

Other suggestions include:

- Selling your car and bicycling or taking the bus to work

- Eating breakfast at home, packing your lunch and cooking dinners more instead of eating out so much

- Canceling subscription services you no longer use or don’t need

- Buying used clothes, furniture, toys, household goods, etc. wherever possible rather than new ones

Let these ideas spur you to think up more ways to make your existing necessities cost less. That’ll only free up more funds to help you pay down that debt faster.

Pay More Than the Minimum

Credit card minimum payments are calculated in such a way as to stretch out your debt repayment as long as possible, thereby earning the credit card companies as much as possible in interest charges.

By paying just a little bit (even $5) more than the minimum payment on each of your credit card bills each month, you cut down considerably on how much that debt costs you over time in interest as well as how fast you pay down that debt.

Pay Off the Most Expensive Debt First

There are at least a couple of different strategies financial gurus recommend for paying down debt, including the avalanche (or ladder) and the snowball.

- Avalanche strategy - You pay down the most expensive (ie. highest-interest) debt first.

- Snowball strategy - You pay down the cheapest (ie. lowest-interest) debt first.

In other words, with either strategy, you pay at least the minimum payment (ideally plus a little bit more) on all your debts.

Then, any extra money you wish to apply toward reducing your debt that month, apply to one debt in particular, based on whichever strategy you choose.

When that chosen debt is paid off completely, you move on to the next one in line, filtering all extra funds above the minimum-plus to that one until it, too, is paid off, and so on.

While there is a psychological benefit to the snowball method, in that, paying off a credit card completely produces a sense of satisfaction and reward that helps compel and inspire you to continue paying down larger debts, this method can also cost you more overall in interest charges before you’re done.

For people with a low income, however, it may be worth eschewing the short-term psychological benefit of paying off a small debt fast in favor of paying less for your debt overall, even if it may take a bit longer to do so.

Transfer, Consolidate and Refinance Balances

Balance-transfer credit cards, debt-consolidation loans and debt refinancing are three powerful tools for reducing the total costs of your debt over time as you work to pay it off.

All three options should be considered carefully before you avail yourself of any of them, but each can help you with how to pay off debt fast with low income, if executed correctly.

- Balance Transfer Cards - Balance transfer credit cards generally offer you a promotional interest rate (often 0%) for a set period of time on any credit card balances you transfer to it within a certain period of time (such as 30 days after opening the card.) The benefit of this is that you can pay down previously interest-bearing debt free of interest payments for a period of time. Of course, any balances you have remaining after that period expires will proceed to accrue interest moving forward until that debt is paid off.

- Debt Consolidation Loans - Similarly, debt consolidation loans offer you a lower interest rate for taking out a single loan to pay off multiple other debts. Debt-consolidation loans combine all your various debts to all your various lenders into a single debt, usually at lower interest. This helps lower your overall costs for the debt while helping you to more easily manage repayments.

- Debt Refinancing - Like the other balance transfer and consolidation options mentioned, debt refinancing offers you more favorable terms on existing debt. With both debt refinancing and a debt consolidation, you replace old loan terms with new ones. The main difference between the two types of loans is that debt refinancing improves the terms of an existing debt (singular) while debt consolidation combines multiple debts (plural) into one, presumably better, loan. The term “presumably” is key here, for not all balance transfer and debt consolidation offers are the same, and not all are equally advantageous. Some could even end up costing you more over the life of the loan, if you don’t choose the option more realistically suited to your actual financial and life circumstances. Therefore, when selecting a balance transfer card or debt consolidation loan, consider carefully all the other terms and fees associated with the offer, including the interest rate after the promotional period ends. Take care that you don’t wind up paying more overall for your debt and paying it down slower by choosing the wrong balance transfer card or debt consolidation offer.

Increase Your Income

Of course, any article about paying off debt with low income would be remiss without offering words of encouragement and aid in increasing that income.

Certainly, the more money you’re bringing in, the faster you can pay down that debt, and just because you’re low-income now, that doesn’t mean there aren’t ways available to you to improve that status.

For example, you can:

- Work overtime - Take on more hours or work overtime at your current job.

- Try to get a raise - Strategize getting yourself a raise and/or promotion.

- Take on a part-time job - Babysit, drive for Lyft or Uber, shop for Instacart, start freelance writing or blogging, mow lawns, shovel snow.

- Sell some personal belongings - Hold a garage sale, take your used books and other media to used dealers, post used electronics, clothing, housewares and collectibles on eBay or Mercari, place a For Sale ad on Craigslist or social media.

- Rent part of your home - Rent to travelers through AirBnb or similar service. Rent long-term to students or other low-income individuals and families.

Budget in Treats

Most importantly while striving to pay off your debt with low income, remember that you don’t have to suffer in the interim.

You don’t have to commit to sacrificing all that give you joy and comfort in life until you’ve paid off all your debt.

In fact, that can actually make it harder to succeed in your debt repayment efforts.

The problem with trying to live a life of total sacrifice until such time as you’re no longer in debt is that it’s an unrealistic and unsustainable goal.

Under such strict and repressive conditions, people almost invariably reach a point where they can’t take it any longer.

Here's what can happen:

- Either they succumb to the next temptation (or few) they encounter, rationalizing it as a well-deserved reward (which it is)

- More drastic yet, throw up their hands in frustration and abandon their whole debt repayment strategy altogether.

Instead, why not incorporate some of these treats, these rewards and comforts, into your minimal-needs budget?

Figure out how much you can reasonably afford to spend each week or each month on your favorite, low-cost rewards and comforts, and set aside the money for them.

Allow yourself to enjoy life at the same time as you work to pay down your debt by making them both part of the same larger plan: your own higher quality of living.

You don’t have to wait until you’re debt-free to start living. You can start reaping the rewards of your renewed commitments to yourself from day one.

Summary and Resources

As you can see from this article, you have many options available to you when trying to pay off debt with low income.

And you don’t have to navigate them all alone—nor should you.

Rather, to determine the best strategy for paying off your debt fast with low income, speak with a financial expert you can trust to assist you.

You can call us toll free at 800.342.2352 or visit us www.121FCU.org. We can help you find the best credit cards and loans available to help with your debt repayment goals, if that’s what you decide you need.