How Many Credit Cards Should You Have?

If your mailbox and email inbox are filled with a constant influx of credit card offers, you're not alone. It can be surprisingly easy to get a credit card, even with little to no credit.

But is it always a good idea to accept every credit card offer that comes your way? Certainly not, of course. But why does it matter?

It matters because the number of credit cards you have affects your credit score.

Failing to understand the impact the number of credit cards you hold can have on your credit score and creditworthiness to lenders, not to mention your own financial security, can lead you to find yourself akin to drowning in debt without anyone willing to throw you a life raft.

Therefore, when looking at the question of how many credit cards to have, the real question that matters is how many credit cards should you have for a great credit score and all the advantages that implies and confers?

The answer to this question may vary considerably depending on your circumstances and needs. It also depends on the balances and credit limits associated with each of those cards.

As FICO Scores VP Ethan Dornhelm explained to CNBC's Make It, there is no ideal number of credit cards to hold that's right for all people.

With that in mind, here are the topics we will be covering in this article.

- How credit cards affect your credit score

- How many credit cards should you have

- Pros and cons of having multiple credit cards

How Credit Cards Affect Your Credit Score

Your credit score is a calculation of multiple factors, the number of credit cards you hold being one of them.

There are also multiple credit scoring agencies, and they each use their own formula weighting each of these factors differently.

Therefore, the number of credit cards you hold can affect your credit score differently depending on the credit scoring agency in question.

As Dornhelm pointed out in his CNBC Make It appearance, in calculating your FICO Score, one of the most widely-used credit scoring systems, the number of credit cards you hold is much less significant than other factors like maintaining low balances in proportion to your credit limits, known as your utilization rate.

For example, if you have a $200 balance on $1,000 worth of credit, that's an utilization rate of 20%.

In general, having too few credit cards can negatively impact your credit score, as can having too many credit cards.

That said, let's explore how, exactly you find the sweet spot for you between those extremes.

How Many Credit Cards Should You Have?

According to FICO, people with the best credit scores (above 800) held an average of three open credit cards. Interestingly, this is also the approximate number of credit cards (the actual is 3.1) held by the average American consumer, according to a 2017 Experian survey.

If you count closed accounts as well as open ones, those with the best credit scores held a total of six credit cards.

The Minimum

Many financial gurus recommend most American consumers hold two open credit cards. Ideally, these credit cards will:

- Come from two different networks (Visa, MasterCard, Discover, American Express.)

- Offer two different types of rewards (cash back, airline miles, etc.)

Note that having cards from different networks doesn't play a role in your credit score, but it does play a role in your purchasing power.

Consider that not all vendors accept credit cards from the same selection of credit card vendors.

If you only have one credit card, then anytime you try to make a purchase with a vendor who doesn't accept cards from that network, you won't be able to make the purchase (at least not by using credit.)

The Maximum

The maximum number of credit cards to hold varies widely, but, when it comes to your credit score, there is definitely such a condition as too much of a good thing.

The more diligent and disciplined you can be with your spending and credit utilization, the more credit cards you can get away with having.

Some consumers, for example, have been known to hold as many as 20 or 30 credit cards at once, or even more.

For other consumers, however, having even two credit cards is too much, or just one.

Some credit card issuers institute maximums of their own when determining whether to issue new credit to potential borrowers.

For example:

An issuer may decide to automatically reject any application for a new credit card if the applicant has already received a certain number of new credit cards within a certain time frame (such as five new cards max over the last two years.)

Consider a Secured Card

By the way, if you are new to using credit or concerned about your own behavior where credit and spending are concerned, a secured credit card can be a great compromise.

With a secured credit card you can:

- Deposit funds into a secure account to serve as collateral in case you default on your debt. Then, your credit limit is simply equal to the amount of money you've placed into that account.

- Rebuild your credit. This is beneficial for those recovering from bankruptcy or other incidents causing poor credit.

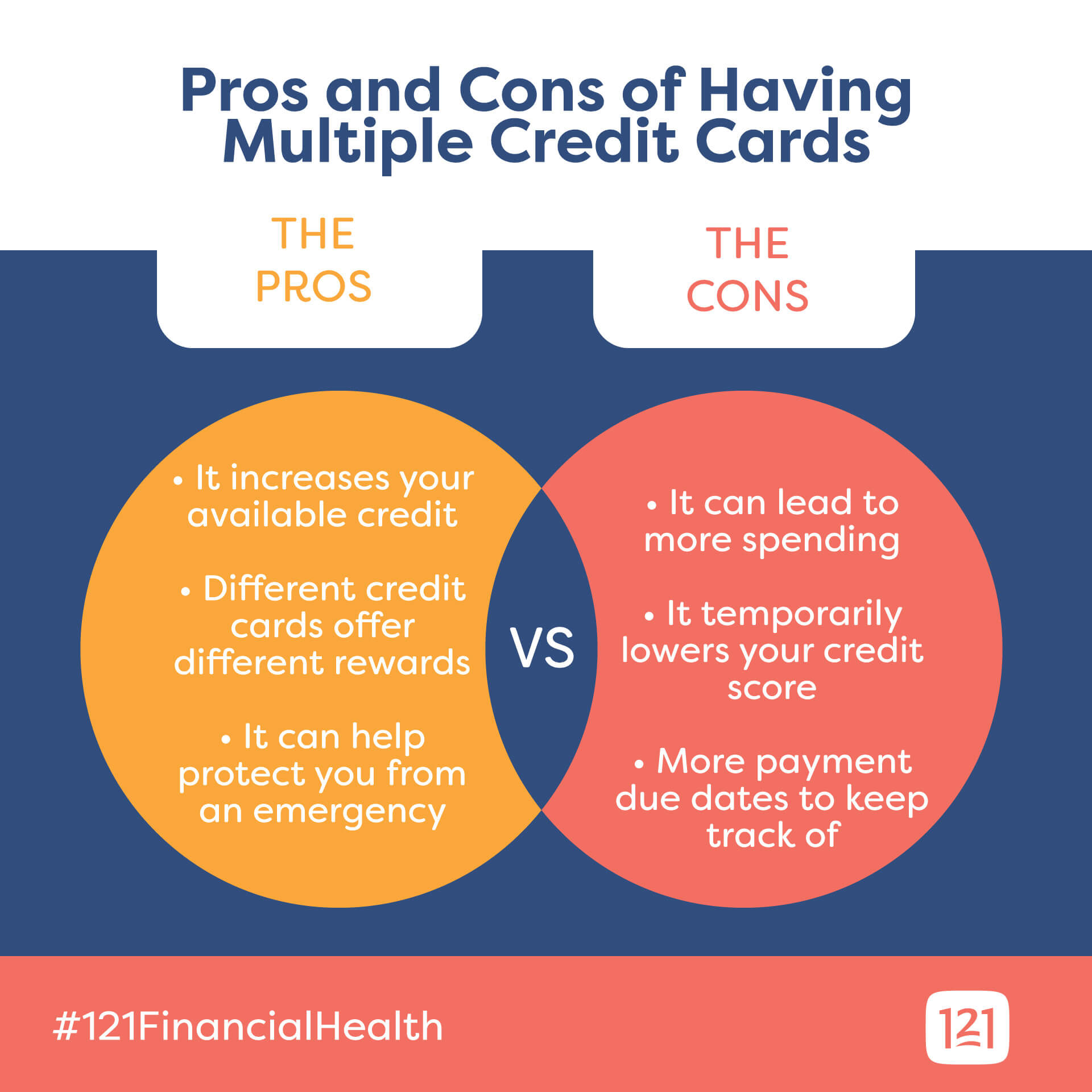

Pros and Cons of Having Multiple Credit Cards

Although its impact may not be as severe as other factors, the number of credit cards you hold can influence your credit score in a variety of sometimes nuanced ways.

Therefore, let's examine the various advantages and drawbacks of holding multiple open credit cards.

Pros of Holding Multiple Credit Cards

It increases your available credit

Opening a new credit card account increases the amount of credit you now have available to you.

If you don't just start using up all of this credit, it can instantly and enduringly benefit your credit score a great deal by improving right away your utilization ratio, or, again, the proportion of credit available to you that you've already utilized.

A good credit utilization rate is typically less than 30%.

If you can get a new credit card with a high-enough credit limit to give you a credit utilization rate of less than 30% given your current total credit card balances (and you commit to not utilizing any of that new credit,) an extra credit card can be a wise financial move.

Let's go back to that earlier example of a 20% credit utilization rate from a $200 balance on a $1,000 credit limit.

If you spend $200 more on that card, your credit utilization rate jumps to 40%.

But, if you then get another credit card with a $1,000 credit limit (now giving you $2,000 total available credit,) the credit utilization rate on that same $400 balance goes back down to 20%.

Different credit cards offer different rewards

These rewards vary depending on the credit card provider.

- Reward Points Credit Cards - These may give you the ability to redeem discounts at various stores, although a credit card issued by a particular store where you tend to shop frequently may give you an even better discount or rewards points rate.

- Frequent-flier Airline Miles Credit Card - These may reward you for air travel at a higher rate than a general rewards points credit card that permits you to apply those points however you wish, including but not limited to future air travel.

For this reason, some people hold many credit cards simply to take advantage of the best available discounts and rewards available at any given time and from any given vendor.

Of course, succeeding with this strategy requires a great deal of time and discipline.

Emergency Preparedness

Another way to use multiple credit cards wisely is to help protect you from emergency.

You can have one card (or more) that you use for regular purchases and another that you keep sequestered away for emergencies only.

This way, you always have funds available to cover a crisis, such as a medical emergency, regardless of how you've been doing with your spending and debt repayment otherwise.

Cons of Holding Multiple Credit Cards

Power breeds temptation

In this case, we're talking about purchasing power, which is precisely what credit brings.

By increasing your purchasing power, you are exposing yourself to increased temptations to buy things you can't afford.

Unless you are extremely disciplined with your budgeting and spending, be aware that the more credit you have available to you, the more likely you may be to spend it.

It temporarily lowers your credit score

Anytime you apply for new credit, whether a credit card or a major loan, you give the prospective lender permission to look up your credit with the major credit reporting agencies (Experian, Equifax and TransUnion.)

This automatically lowers your credit score a small bit.

Lenders do realize that you may shop around for the best deal while you look for credit. Therefore, multiple credit inquiries by multiple potential lenders does not progressively lower your credit score, so as long as those inquiries occur within a short time frame of one another.

That is why financial experts commonly advise that you conduct all your credit shopping at once. Your credit score will go down a slight bit, but it won't affect that particular round of shopping for new credit.

Then, as long as you wait a little while (generally several months, in most circumstances) before applying for more new credit, that negative impact on your credit score from those credit inquiries will expire.

Managing repayment schedules

The more credit cards you have, the more payment due dates and required minimum payments you have to keep track of.

Any missed or late payment could have a negative impact on your credit score and cost you additional fees and interest charges.

What's more, if you have a limited-time promotional rate on a card, you could put that in jeopardy by making even one such mistake.

Then, all the balances you've accrued so far on that card could be charged a much higher interest rate than you've accounted (or budgeted) for so soon.

Appearance to New Lenders

Lenders frown on potential borrowers who appear too financially stretched already to meet any new credit demands.

As such, the more credit cards you hold, the harder it may be to get certain lenders to approve you for such other debts as a home, car or personal loan.

It can, likewise, be more difficult to refinance debt, or refinance with favorable terms, if the given lender perceives you as having too much credit available to you already.

Before Closing Any Credit Card, Read This

One last word of warning: closing a credit card account can also have a negative impact on your credit score, especially if it's your oldest or biggest open line of credit.

Specifically, it lowers the average age of your overall credit accounts and could shorten the length of your total credit history, both of which are factors considered in calculating your credit score.

Therefore, if you have concerns you may have too many open credit cards already, consider carefully whether closing any of them will do your credit score more harm or good, and which card or cards, if any, would be best to close.

In some cases, it could be wiser to keep a credit card open and only use it now again for small purchases you can repay in full when your bill comes in each month.

This way, that card can still help you build better credit by allowing you to continue demonstrating responsible borrower behavior without inadvertently damaging your credit by reducing your credit utilization rate and possibly shortening the length of your total credit history.

Summary and Resources

As you can see from this article, it's not just the number of credit cards that matter when determining your credit strategy.

You must also consider your goals and current financial circumstances, including:

- Your spending habits

- Your ability to repay your debt

You must consider as well factors of the credit cards you choose, including:

- Their providers

- Their limits

- Their APRs

- Their rewards

Where to Find Help

For help navigating your credit card options, call us at 904-723-6330 and speak with one of our financial experts or visit our credit card page to learn about what we offer.