How to Avoid Debt? The 10 Best Ways to Do It

Into every life, a little debt will fall but effectively taking charge of one's finances can be the difference between shaking it off and being buried beneath it. Debt makes life much more difficult to enjoy and it can hold people back from achieving the level of success of which they are capable of.

By avoiding debt, a person can open new avenues and work toward building the life they want.

Luckily, there are proven steps that consumers can take to avoid the financial turmoil of overwhelming debt. The first step is to understand where debt comes from so that it can be avoided entirely.

How Does Debt Accrue?

The main area of debt accrual is through overextending oneself. Spending more than a person can feasibly afford based on their income is the leading cause of debt for consumers.

Being proactive about where one's money goes is the best way to avoid debt. Conversely, free spending and overextending oneself is the fastest way to build debt.

There are four major areas of debt in the United States:

- Credit cards

- Car loans

- Mortgages

- Student loans

These debt categories can pose a serious threat to a person's financial security. This is due to the fact that they are often neglected.

In fact, according to the New York Federal Reserve, the total household debt in the United States increased to more than $14 trillion in the last quarter of 2019. Most of that debt falls under the four categories above.

Poorly handled household expenses and finances are one of the leading causes of stress for American adults. That makes avoiding debt all the more important for a satisfying life.

How to Avoid Debt?

While many can avoid credit cards and student loans completely, most people cannot go through life without accruing either a car loan or a mortgage. Even if they can, there are everyday expenses that will always threaten to tip a household into the debt category.

Consumers must be vigilant with their finances to avoid falling into the trap of debt. It takes dedication and a willingness to forego things a person wants in favor of only what they need.

Avoiding debt requires sidestepping spending whims while establishing a sound financial plan. The steps that follow are an excellent roadmap for doing just that.

1. Establish a Budget & Stick to It

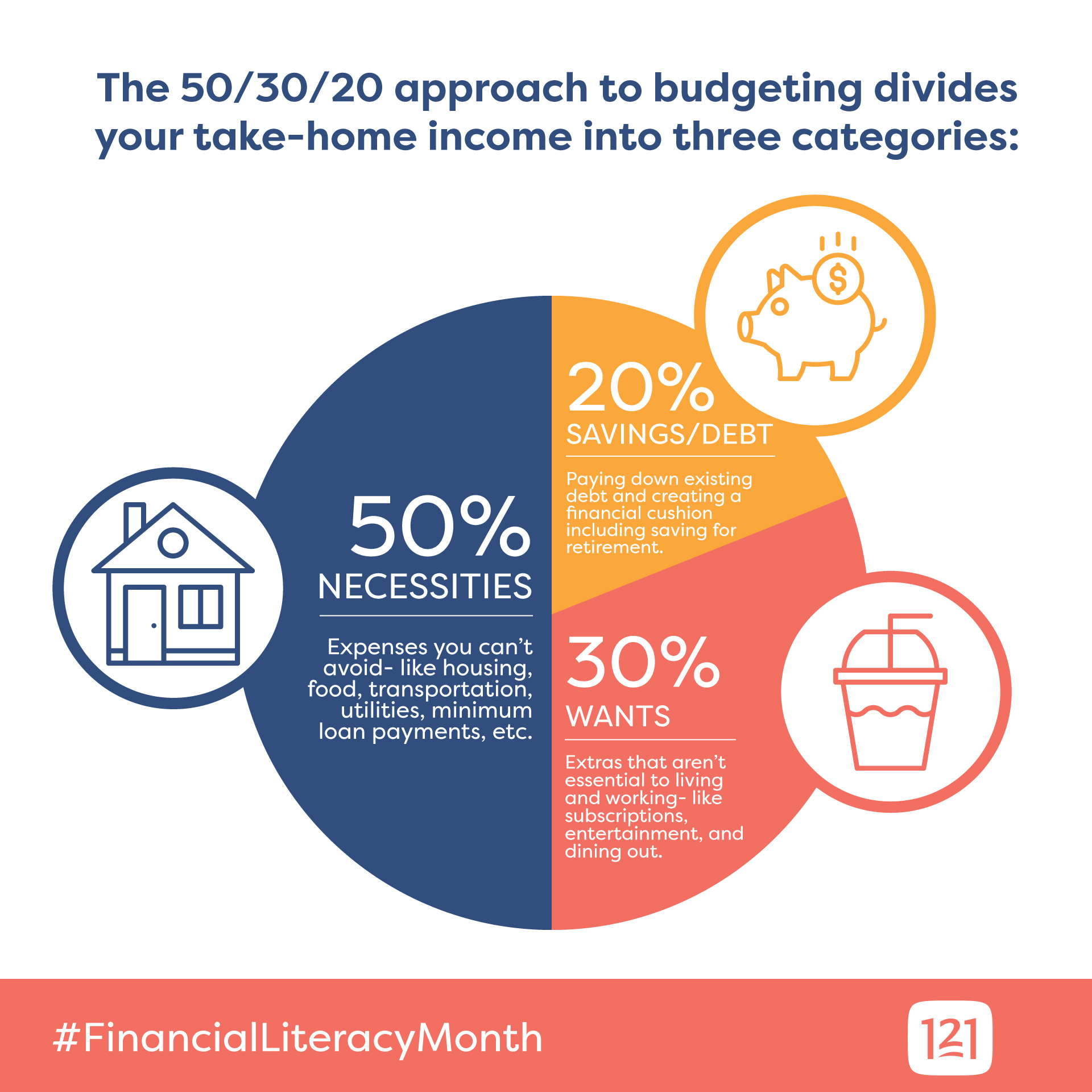

Keeping track of expenses with a master sheet allows consumers to ensure they make full payments on time to avoid any late fees. A good philosophy to follow is the 50/30/20 guideline for net income.

It states that consumers should set aside:

- 50% for essential expenses such as food, shelter, utilities, transportation, child care, insurance and minimum loan payments.

- 30% for luxuries like going out to eat, trips and holiday giving.

- 20% for savings and to pay down any debt already amassed.

By parceling out the money for each expense monthly, it is easy to see where cuts can be made if necessary. There are many online budgeting tools available to help.

Trying to pay large chunks all at once can be daunting. By breaking monthly expenses down into weekly or biweekly pieces can take some of the pressure off and make people less likely to miss a payment.

Dividing monthly bills by pay period ensure that there will be plenty of money to cover the expense before it is due.

2. Pay Bills on Time or Early

Late fees are the bane of anyone trying to establish good financial habits.

Paying all bills on time or early will avoid these unnecessary expenses. Moreover, keeping a solid payment history helps to build one's credit, which is a hallmark of a solid financial outlook. This should be easy with the use of a well laid out budget.

Applying that budget to a calendar can help with this task. It can be simple or elaborate as long as it gives a visual reference that allows the consumer to easily see when bills are due and how much needs to be sent.

This is especially important for anyone who owes a tax debt. The more money somebody makes, the more they owe in taxes. Somebody who owes taxes to the federal government needs to make sure they are paid quickly and correctly.

If the amount is too much to handle at one time, the IRS will work with Americans. Simply give them a call and discuss extension and payment plan options.

3. Keep an Emergency Fund

Socking away a nest egg for a rainy day is a great way to avoid debt.

This money can help to cover expenses if something unexpected happens such as:

- An injury that prevents working

- Emergency costs

- Loss of a job, or the like

Most financial experts recommend having six months of salary put away for emergencies. Three months might be more realistic but even that seems difficult for most American households.

According to the 2018 National Financial Capability Study (NFCS), less than half of U.S. households have three months' salary saved.

Establishing a special savings account in which to keep this emergency fund can help to make it easier. In addition, many financial institutions pay interest on their savings accounts. That means that a person's money will be making them money while it is tucked away for emergency use.

4. Maintain Full-Time Employment

This seems like a no-brainer, but it needs to be said: maintaining full-time employment is essential to avoiding debt.

This means adhering to basic work etiquette such as:

- Being on time

- Performing at or above expectations

- Fostering positive relationships with colleagues to avoid being fired or laid off

It also means not leaving one position until another is secured.

Beyond just keeping a job, the best financial plan includes climbing the ladder into a better position.

For this, people need to keep their thumb on the pulse of their industry to be aware of changes as they happen. They should also continue to expand their education with the help of experts in their field. Further education is also a great idea if it fits into the budget.

Keep in mind, when promotion and the commiserate raise that go along with it happen, that does not mean there is more money to spend. It means there is more money to save.

Apply the 50/30/20 guideline to any new addition to the income side of a budget.

5. Use Credit Cards the Right Way

The first rule of credit cards is:

You should only use a credit card if you have the cash to make the purchase.

You may wonder then why you would need to use the credit card at all.

That leads to the second rule of credit cards, the only reason to use a charge card is to reap some additional benefit.

That could mean cash-back rewards, airline miles or some other incentive.

Rule number three for credit card use is to avoid cash advances. These generally carry a fee and a higher annual percentage rate (APR) than regular charges. Again, if it does not fit into the budget that is established, borrowing money on a card is not the answer.

A good fourth rule for credit cards is to pay the balance in full as soon as possible. If possible, send the payment the next day to avoid the chance that it gets overlooked.

Finally, limit the number of cards used. Multiple revolving accounts are easier to lose track of and become overwhelmed by. In the end, they are a fast road to future financial struggle and the need for debt consolidation.

6. Think Hard About Auto Loans

When considering a new auto loan, the cost of insurance and maintenance should also be considered. It is also important to shop around for the best terms. Different lenders offer different interest rates. Finding the best one is a great way to limit debt.

Instead of getting into a monthly payment with interest, it might be in a person's best interest to look for alternatives to a new car purchase. The average difference between new and used cars is a whopping $13,000 according to the Federal Trade Commission (FTC).

The payment amount and terms of a loan on a used car are generally much easier to manage. Furthermore, saving up and paying cash for a gently used car will avoid a car payment and interest altogether.

7. Be Smart About Mortgages

The key to buying a home is waiting until a person is financially ready for everything that comes with it. Homeownership is a serious financial endeavor that should be carefully considered – or even discussed with a financial advisor – before going forward.

According to the Federal Reserve, homeowners in the United States struggle with nearly $9 trillion in mortgage debt each year. That amounts to roughly $175,000 per household. Much of this could have been avoided with proper preparation.

Before obtaining a mortgage, borrowers need to be aware of the debt-to-income (DTI) ratio that lenders will use to determine what they can afford. A person's DTI ratio is the amount of their gross income needed to cover their monthly expenses (debts).

Many mortgage lenders require a DTI ratio of less than 43 percent to qualify but the majority of financial experts recommend staying under 35 percent for financial security.

The lower the DTI, the less risky a person is considered to be financially. Moreover, the less risk the consumer takes by entering into the debt.

When buying a home, consumers need to remember that homeownership also entails other expenses, such as:

- Homeowners' insurance

- Property taxes

- Maintenance costs

- Mortgage payment

8. Avoid Student Loans

While the cost of an education can be daunting, that is nothing compared to the crushing debt many Americans face from student loans. If it is possible, they should be avoided at all costs.

Attend a community college where costs are lower. Only take classes that can be paid for in full. Apply for grants and other assistance that does not need to be repaid.

If a student loan is unavoidable, make sure it is managed properly.

Do not fall into the trap of thinking that the money from a student loan can be used for living expenses. While that is perfectly legal, it is a bad financial move.

Never take more than is needed to cover whatever costs exceed a person's budget. Besides, anyone who cannot afford to pay their basic living expenses without the help of a loan … cannot afford college.

9. Exercise Caution When Starting a Small Business

If starting a small business is in the plans, those plans better be extensive to avoid failing and falling into debt.

According to the Small Business Association, the three primary reasons most small businesses fail in the first five years are insufficient capital, poor credit and … excessive debt.

The best way to avoid these pitfalls – and the debt they bring – is to plan and budget carefully prior to opening the business.

Many lenders have financial experts that can help entrepreneurs do just that, as does the Small Business Administration. Preparing to start a new business opens the door for a whole new host of debt possibilities and people need to be sure they are prepared to handle it to avoid debt.

10. Use Coupons & Rebates

Every penny, nickel and dime saved adds up.

- Clip coupons from the newspaper

- Look for sales

- Sign up for those discount apps and complimentary store membership programs that provide discounts, coupons, rebates and other savings

- Find ways to hold on to as much income as possible

Sometimes staying out of debt is as simple as saving a few dollars on a new appliance or groceries.

The Bottomline

Everybody has expenses but with a mature financial attitude, anyone can avoid debt. Understanding where things can get out of control with a person's finances can help them rein in the problem before it gets too extreme.

If all else fails, reach out for help from professionals from within the finance industry. We are here to help. For expert savings, credit card and loan services to help with your financial future, visit 121 Financial Credit Union today.