How to Build an Emergency Fund for Unexpected Expenses

"Into every life, a little rain must fall". "Expect the unexpected." "A bird in the hand is worth two in the bush".

These tried and true phrases have warned people for generations to plan for the little surprises life throws at everyone.

That is the same philosophy behind building an emergency fund.

Emergencies pop up in every life and when they do, they often bring along a price tag that you may not be prepared for without an emergency fund.

Broken appliances, fender benders, sudden loss of income, unexpected medical bills, and other unplanned expenses often come at the worst possible time.

Without an emergency fund, this can be catastrophic to your household budget.

Having a dedicated savings account to absorb the extra expense of an unexpected event will provide the breathing room you need and allow you to stay on target for your financial goals.

Understanding the ins and outs of emergency funds will allow you to comfortably build a financial cushion for unexpected expenses.

If you are wondering how to build an emergency fund, read on.

What is an Emergency Fund?

An emergency fund is a special cash reserve set aside for the specific purpose of absorbing the financial impact of unexpected expenses.

There is a long list of expenses that could pop up and create a drain on your financial resources.

- Car repairs

- Medical bills

- Home repairs

- Increases in utilities

These are all common unplanned expenses that can throw a budget into turmoil.

Deaths, births, marriages and other events that occur in every family will often bring with them expenses for which nobody can plan.

Likewise, the sudden loss of income can leave you scrambling to pay everyday expenses.

An emergency fund allows you to cover these unexpected expenses without throwing off your regular budget. In that way, it is a method to avoid debt.

Why Do You Need an Emergency Fund?

The obvious answer here is that you need an emergency fund to absorb the financial shock of sudden expenses.

What that means is a little more complex.

An emergency fund prevents the immediate damage an unexpected expense poses to a household budget. It also avoids the accrual of debt associated with the financial ripples caused by having to take money earmarked for one expense to cover another.

Those without emergency funds are often forced to find avenues to pay for emergency expenses that may lead to further debt.

Doing so will set back your financial goals and may incur additional charges in the form of interest and fees.

Here are some examples of what can set you back financially:

- Taking out high-interest loans

- Charging costs to credit cards

- Pulling funds from other areas

As NerdWallet columnist Liz Weston said, "One of the first steps to climbing out of debt is to give yourself a way not to go further into debt."

How Much Should You Save?

How much you tuck away in an emergency fund depends entirely on your unique set of circumstances.

There are some basic guidelines put forth by financial experts, but these are intended to be customized to meet each person's financial situation.

As a baseline, experts recommend:

- A minimum of 3 months salary for salaried employees with the ideal being 6 to 9 months.

- A minimum of 6 months for freelance, self-employed, and other non-traditional workers with the ideal being 9 to 12 months.

Another way to determine how much to put away is to look at your average expenses.

By knowing roughly how much money you need to maintain your current standard of living for an extended period you will be able to access how much you need to have put away in the event that all income stops for some reason.

You can then build an emergency fund that can cover those costs for an extended period – 3, 6, 9, or 12 months – if the worst happens.

Make it a goal to set aside $500 and then raise that to $1000 and continue until you have put away enough to cover your expenses for 6 months.

The key is to have enough to cover whatever may come up to maintain your current budget and standard of living.

Even if this is too much for your budget to handle, put aside a little every chance you get.

Even a small emergency fund is better than none at all.

Where Should You Keep Your Emergency Fund?

For an emergency fund to be effective, it needs to be kept in a place where it is:

- Secure from theft

- Easily accessed for emergency use

- Safe from usage for non-emergency purposes

Depositing your emergency fund into a savings account with a high-interest rate that can be accessed through an ATM card meets all three requirements.

Make sure that you do not get a debit card through because then it becomes too easy to spend those funds elsewhere. Keep it a dedicated account for the same reason.

If that is not an option for you, there are other avenues.

- Get a pre-paid card - A prepaid debit card allows you to load however much money you want onto it and if you can resist the temptation to spend it, you can add only your emergency funds to it.

- Keep cash at home - If all else fails, you can always keep a cash stash in your home for emergencies. This is the least secure and the easiest to tap into for non-emergency reasons, but it is also the most easily accessible.

Where you keep your emergency fund depends on your specific needs and situation. The key is to remember what it is for and commit to saving it for exactly that.

Strategies for Building an Emergency Fund

Building an emergency fund may seem daunting but by following a few simple steps it can be easy for anyone.

In the long run, it is much easier to save for future emergencies than it is to come up with the funds to cover those expenses at the moment that they are happening.

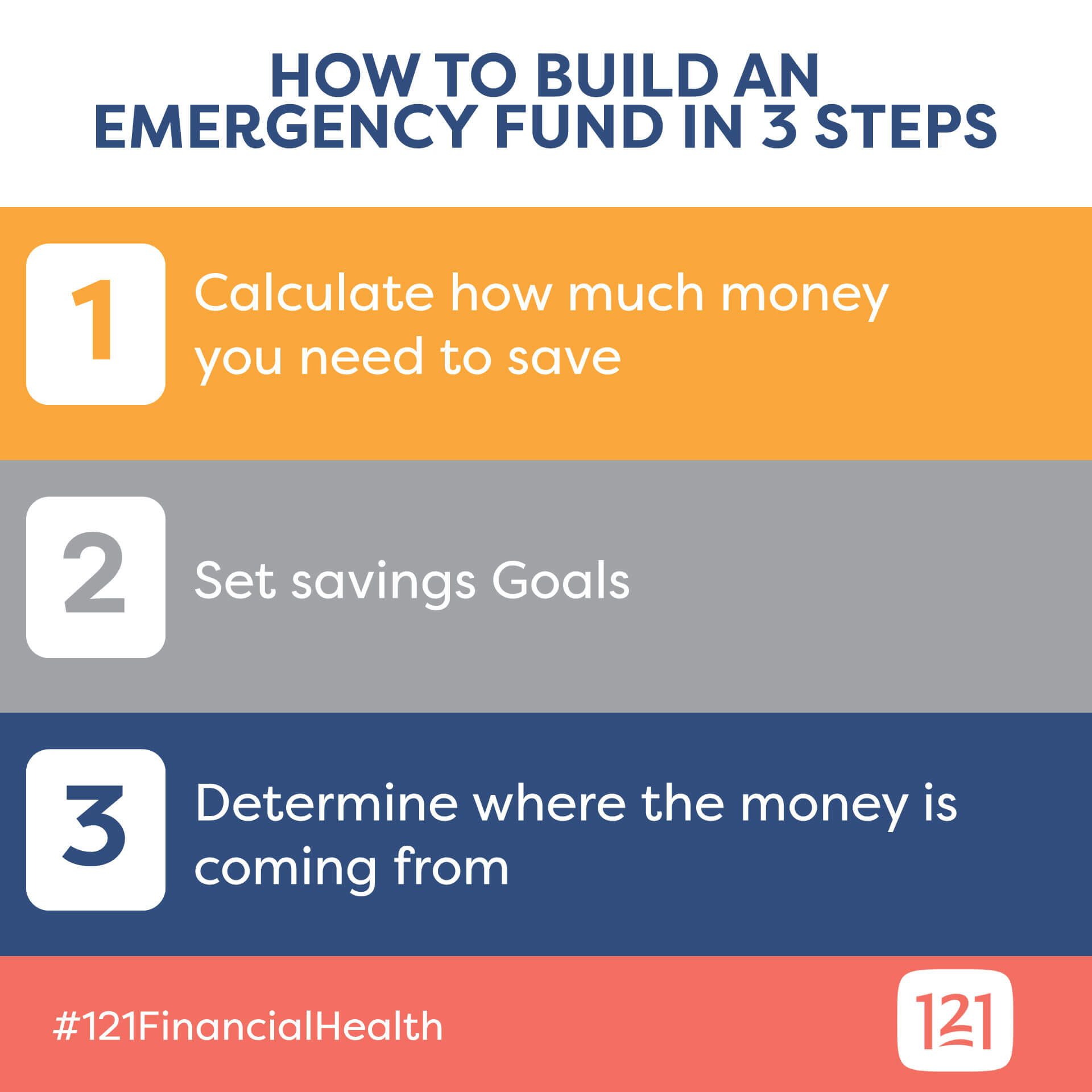

1. Calculate how much you Need to save

Start by calculating what you need to have saved.

You can follow one of the guidelines outlined earlier in this article or utilize an emergency savings calculator to determine how much you need to have put away for emergencies.

2. Set Savings Goals

Once you know how much you want to have in your fund, set a monthly savings goal. Be realistic and set a specific date by which you want to have your emergency savings fully funded.

For example:

Imagine you want to have $1,200 saved by the end of this year. If it is January, that gives you 12 months to save that money.

While thinking about trying to save a chunk like $1,200 can seem overwhelming, the concept of putting away $100 a month is much more manageable.

3. Determine where the money is coming from

Now that you have planned how much you want in your emergency savings and when it should be fully funded, you need to determine where those funds are coming from.

For some, that may be as simple as setting up a direct deposit into a dedicated savings account. Others may need to adjust their budgets or add income sources to fund their emergency savings.

If you have a consistent income, consider having your monthly goal directly deposited from your paycheck into the dedicated savings account you have established for your emergency fund.

Most payroll processing services utilized by employers allow you to split your deposit between multiple accounts.

If not, you can set guidelines at your financial institution to do just that when the funds arrive.

There are also several apps out there that allow you to round up purchases and then put the extra change into a savings account.

While this may not seem like it would add up to much, over time your pennies, nickels, and dimes create nice little savings.

If you need to adjust your budget, look for areas where shaving off a little bit will help you save a bunch.

- Clip coupons

- cancel unessential memberships and subscriptions

- turn down the thermostat a degree or two

- pack a lunch for work

Trimming a little fat off your budget will allow you to put away more without you noticing a huge change.

If your budget is as neatly groomed as it can get, you may need to explore new avenues of income to fund your emergency savings.

This could mean many things including:

- Selling Stuff - Most people have things laying around their houses that they do not need anymore. Selling unneeded or unwanted items can provide a nice chunk to put towards an emergency fund.

- Adjust Withholding - This can work two ways. You can either increase your withholding or lower it. Lowering withholding provides more money in each pay period that can then be squirreled away for emergencies. Increasing your withholding will reduce the amount you get in each check but will pad your tax return with extra funds.

- Save Your Refund - After adjusting your withholding to increase your tax refund, make sure you put that money towards your emergency fund. Even if you left your withholding the same, tax refunds are a great way to start or boost an emergency fund.

- Put Away Cash Gifts - If you get money throughout the year in the form of birthday, anniversary, or holiday gifts, add that extra cash to your emergency fund. Whoever gave you the gift will undoubtedly be fine with you saving their present to secure your future goals.

- Add a Side Hussle - Do you have a hobby or skill? Put that to use and make a little extra money on the side. Enjoy crocheting, baking, woodworking … sell blankets, brownies, benches at a local flea market or through an online store. Handy with a hammer and saw … offer handyperson services in your community.

- Get a Second Job - If all else fails, you could take a second part-time job for the sole purpose of funding your emergency fund. You can even have your paycheck from this supplemental income directly deposited into a dedicated savings account for your emergency fund.

While saving for the unexpected may seem out of reach for some, by utilizing the suggestions outlined above, anyone can create a cushion for unplanned financial crises.

However, saving money is only half the battle. You then need to make sure that it goes where it needs to when it needs to.

How Do You Manage an Emergency Fund?

If you have made it this far, you have already demonstrated the tenacity it takes to succeed in managing your emergency fund.

Carefully monitor your emergency savings to ensure that you are meeting your monthly goals and optimizing your savings potential.

Set guidelines for what constitutes an unplanned or emergency expense to prevent misuse of the emergency account.

It can be easy to fall into a habit of considering every unexpected cost as something that should be paid out of your emergency fund, but this will quickly deplete the account and leave you in the lurch if a real emergency occurs.

TIP: Remember to plan for ways to rebuild your emergency fund throughout the year. If you find more money in there than you need, transfer it to a separate savings account earmarked for another purpose.

Final Thoughts

Once you have created an emergency fund to handle unexpected expenses, take a moment to congratulate yourself. You deserve it. You have taken an important step toward ensuring the financial security of your household and you have every right to celebrate and be proud.

Feel good? All right, back to work.

Once you have that financial cushion an emergency fund provides, it is time to begin looking at other areas where your money will benefit you the most.

Begin or add to your retirement fund, plan for the future with college funds for the children you want to have, work towards paying off your mortgage early.

With an emergency fund in place to help you weather financial storms, you are free to plan for the future.

Let our financial experts at 121 Financial Credit Union in Jacksonville help you with all your banking and planning needs today.