How to Create a Budget You Can Live With In Seven Steps

How would you feel knowing that you had solid plan in place that is easy to follow and gives you the chance to prepare for the future and its surprises?

According to a recent survey by the Certified Financial Planner Board of Standards, those who set and use a budget said that it helps improve their mental health and well-being by giving them a sense of “agency" over their finances. For example, among a small online sample of consumers between the ages of 35 and 65, their survey found that:

- 62 percent said their budgets made them “feel more in control” over their money

- 55 percent said it boosted their confidence

- 52 percent said it made them “feel more secure”

Respondents who didn’t set a budget, on the other hand, were more likely to report feeling out of control or anxious by financial stress.

Here at 121 Financial Credit Union, we truly care about your financial security and wellbeing and have developed this guide detailing how to create a budget that works.

Table of Contents

- Do I Really Need to Make a Budget? Why Most Fail...

- STEP 1: Define Your Financial Goals

- STEP 2: Identify Your Net Monthly Income

- STEP 3: Calculate your Current Monthly Expenses

- STEP 4: Create a Rough Draft of Your Budget

- STEP 5: Adjust and Rework Your Rough Draft Into a Final Budget

- STEP 6: How to Implement and Track Your Budget

- STEP 7: Regularly Revisit and Refine Your Budget

- Bonus: Final Thoughts on Creating a Budget

Do I really need to Make a Budget?

There are so many excuses for ignoring the mere concept of budgeting your personal finances. Budgeting has unfortunately earned a bad reputation: It can be time-consuming. It’s deemed restrictive. It's a bunch of rules and regulations. It’s not seen as fun.

It’s predominantly viewed as the financial version of dieting.

But we’re here to flip that mindset around.

The benefits of financial independence that come with a budget far outweigh the perceived challenges of creating and sticking to one.

And although a budget can’t fix structural issues that can affect your finances – such as sudden unemployment or lowered income – it can at least make you feel more confident about staring down your financial challenges and surviving them with a positive attitude and confidence.

Why do Most Household Budgets Fail?

A budget should cover all of a household's needs while providing an emergency fund and savings for the future. A realistic budget will do all of this while allowing for the wants that make life enjoyable.

After all, a budget is simply a tool to help you reach your financial goals. It is not meant to be a monetary straight jacket.

Most of us know it isn’t the exact formula of making a budget that's difficult— It’s actually sticking to it. That’s the hard part!

Your Greatest Ally is Your Mindset on Budgeting

"Most people approach budgeting like a diet—it triggers a sense of deprivation,” Financial Therapist Brad Klontz says. “As a result people tend to avoid doing it, slide back into overspending or be sloppy or dishonest with themselves when looking at the numbers.”

Another huge reason many of us have failed at actually sticking with a budget is that we treat budgets as an unforgiving picture of how we’d like to spend our money in an ideal or fabricated scenario… instead of the way we need to spend our money right now to meet our current financial goals.

Creating a realistic budget from the very beginning and then adjusting as needed will help guide you to not only create a custom plan that is comfortable as well as effective… it will help you reframe your mindset of budgeting and create a lifestyle instead of a forgotten resolution.

You’ll stop seeing it as a dreaded chore, and instead, as an enjoyable tool and skill towards your financial freedom and happiness.

Start on that path to financial freedom and follow the steps below to help create a personal budget that works for you.

Read on to learn about defining your financial goals, determining your expendable income, calculating your expenses, drafting a budget, implementing that budget, and then monitoring and adjusting it when needed.

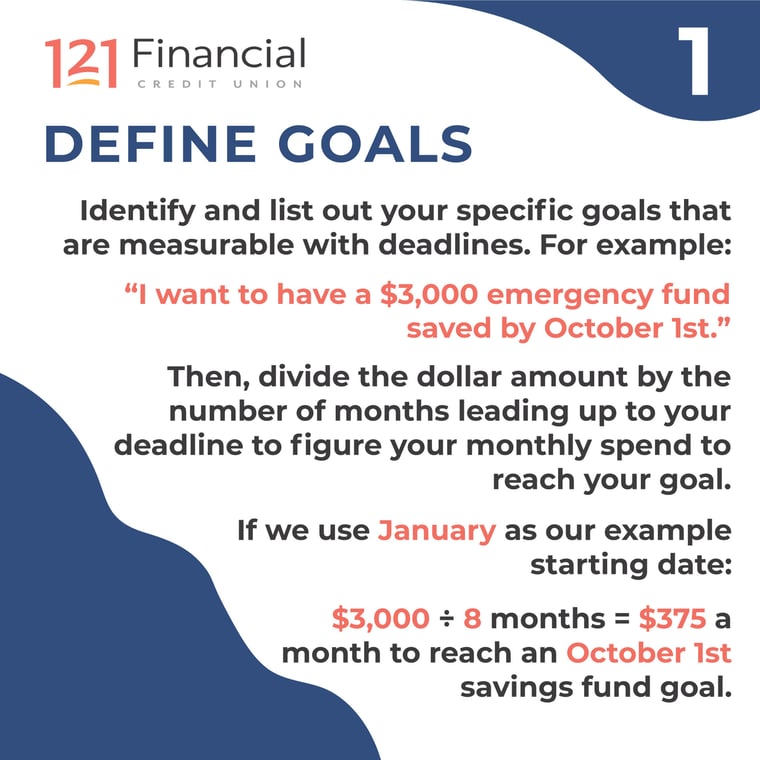

STEP 1: Define Your Financial Goals

Nearly everyone’s talking about and looking for ways to make and save money, but if you don’t have a purpose for it, what’s the point?

The first step to creating a budget is defining what the purpose or goal of that budget is. Are debts getting out of control? Are you looking to plan for retirement? Is there a child's college fund to consider? Is there something needed that has always been out of reach financially?

Financial goals can be short-term or long-term. Short-term goals are those that can be accomplished in one year or less, while long-term ones may take many years to achieve.

Identifying what your goal is can help steer the budget in the right direction by defining the “WHY” of your finances. And when you’re focused on the “WHY”, it makes it a lot easier to stay on track. For instance, knowing that the brass ring of your 2021 budget is reducing debt by a certain amount so that you can improve your credit score can make it a much easier and enjoyable journey.

TIP: Try to only set one goal at a time to avoid becoming overwhelmed or feeling discouraged because you weren’t able to meet unrealistic expectations.

Set goals That are specific, measurable, and have a set deadline.

Let’s use an example to better illustrate what a “specific” goal is. Let’s say that you’ve said before that your goal is saving money. We’d all like to have a stash of cash in the bank... But “saving money” is too vague to be a motivating factor to stick to a budget.

To be specific with your goal, say instead: "My goal is to have an emergency fund..."

Make it measurable by adding: "with $3,000 in it...”

Then, define your deadline: "by October 1st.”

Put it all together, and you’d say: "My goal is to have an emergency fund with $3,000 in it by October 1st.” You’ve just set a specific and measurable goal with a deadline!

Even though you now know how to define your goal, there’s still one more piece to this...

Break down your big goal to Smaller goals for a Plan

Whether goals are short-term or long-term, they revolve around the available income to fund them. Let’s keep using our example emergency fund goal above to show how to create your plan to reach it.

Let’s say you’re starting January 1st. That means there are eight months in which to save for this goal before your set deadline.

Divide the measurable goal amount by the time to achieve it to determine the monthly amount that will be need to be saved. In this instance that would be $375.

Now you know that you should be putting away $375 each month – or roughly $75 each week – to allow for the goal to be reached.

TIP: Emergency funds are an excellent goal to have. Most financial experts recommend that salaried employees put aside a minimum of three months' salary for unexpected expenses with nine months being the ideal. Those with variable incomes are advised to keep nine to twelve months' worth of income for these emergency funds.

Step 1 Recap:

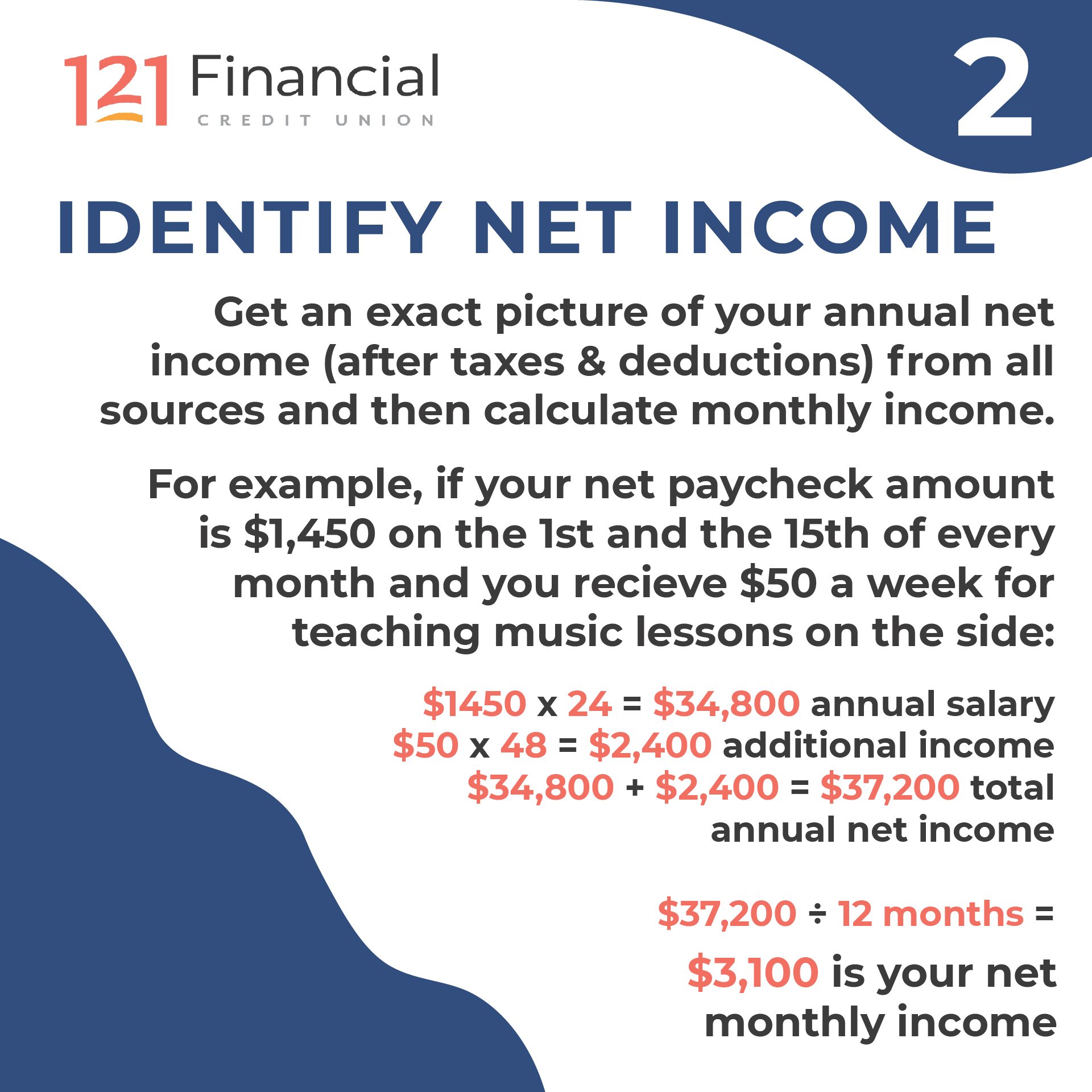

STEP TWO: Identify Your Net Monthly Income

Once a goal has been set and defined with a plan, it's time to get down to the number crunching. Every budget creation starts with the total expendable income of the household.

Budgets can be destroyed before ever getting off the ground if a person tries to use their gross income instead as their baseline of what is available to spend. Your expendable income is also known as Net Income.

Net income is the amount you receive and bring home after all deductions are taken out. These deductions can include taxes, flexible spending accounts, 401(k) deposits, union or other professional dues, and health insurance premiums that are tied to your employer.

Calculating Your Net Monthly Income

As an example, let's assume that a person's net paycheck is $1,500 and is paid twice a month on the 1st and 15th. They also receive $50 each week for music lessons they provide. Their total net income would then be $3,200 per month.

If a person receives regular paychecks or direct deposits of their pay, they can simply use the take-home amount as that is their net income.

Those who are gig workers, self-employed, or otherwise non-traditional in how they are paid will need to do a little more math.

Variable incomes that come from these types of work often have busy seasons or dry spells. To create a household budget that works, use the income from the lowest-earning month in the last year as a baseline for your income.

If there is a hobby that has become a side hustle, don’t forget to include that amount in total income. If not, consider starting one for a little extra padding in the household budget.

Simply include all the income earned from every source. When it comes time to deduct expenses, mandatory deductions like taxes and social security will have to be accounted for.

TIP: It is always better to underestimate your monthly income than to overestimate. When in doubt, round down for your net income.

Step 2 Recap:

STEP THREE: Calculate Your current Monthly Expenses

Now that you’ve got your goals set and your total net monthly income has been established, it is time to look at expenses. Although it may seem tedious at first, the key to this step is being as thorough as possible.

By creating a realistic picture of current expenditures, it is easier to identify where the money is going and to find areas where adjustments can be made later.

Fixed Expenses

Start with fixed expenses. Fixed expenses are those that are mandatory expenditures and they generally have a standard monthly amount that needs to be paid.

These include expenses such as:

- housing costs like mortgage payments or rent

- loan payments of all sorts

- credit card payments

- insurance and healthcare

...and anything else that is necessary and that has a relatively constant monthly payment amount with a regular due date.

It's unlikely that fixed expenses can be changed, so knowing how much of a household's monthly income they take up is essential to budget development.

Variable Expenses

Fixed expenses are fairly simple to predict. But variable expenses are the next group to consider. These are the expenditures that may change from month to month.

They are also the area where cuts can be made if more money needs to be freed up for something else.

To assemble this list of expenses, look to credit card and bank statements that itemize and categorize expenditures. For variable expenses, averaging past spending habits for three to six months can help determine a rough estimate.

When making a list of expenses, these categories need to be included in some way to ensure that every penny spent is accounted for. Missing one expense could throw off an entire budget.

Don’t Forget Occasional Expenses

Not all fixed expenses are monthly expenses. Things like bills that are paid quarterly or annually like car registrations or HOA dues may not be on your monthly radar, but they are still predictable, and should not be forgotten when recording your expenses.

Common Household Expense Categories

- Shelter expenses: This includes rent as well as a mortgage payment.

- Fixed loan payments: Remember that there are several types of loans that need to be taken into consideration. These include auto loans, home equity lines of credit, payday loans, and personal loans. Student loans also fall under this category.

- Insurance: Again, make sure that all forms of insurance premium are considered. If health insurance premiums are not taken by the employer, they need to be paid out of pocket. The same is true for homeowners' insurance not included in the mortgage or home equity loan payment. Also consider auto insurance, life insurance, pet insurance, and renter's insurance.

- Groceries: A variable expense, setting a weekly or monthly menu can make this amount easier to stabilize. Do not forget to leave room for holiday meals and special occasions.

- Utilities: This is another category that has several components that vary greatly from household to household. Electricity, gas for heating and cooking, and water and sewer services are the most common utilities with trash removal also included in the category at times.

- Entertainment: This is another broad category that could be broken down into its individual parts. Dining out, streaming services, internet service, nights out, and anything else that makes life more fun generally fall into this category.

- Child care: While this is predominantly for daycare costs, it can also be broken down to include clothes, school lunches, field trip costs, and other variable expenses that come with having children.

- Personal care: Another category that will be unique for each household, personal care encompasses a plethora of expenses. Trips to the salon, regular prescriptions, gym memberships and clothing all fall under this category. Medical expenses like copays and the like can also be included here.

- Transportation costs: Getting around in the world costs money too. Whether it is cab fare or gasoline for a vehicle, transportation costs need to be accounted for. Remember that cars have maintenance costs as well.

- Savings: Do not forget to include a spot to save money for the future. Whether it is an emergency fund to head off life's unexpected expenses or seed money for a new business, saving is an important part of any budget.

- Surprises: This is a handy category for anyone without an emergency fund established. It can head off major expenses from unexpected events like a large car repair... or even something as small as provide the $20 needed for a birthday party gift the kids forgot to mention.

Step 3 Recap:

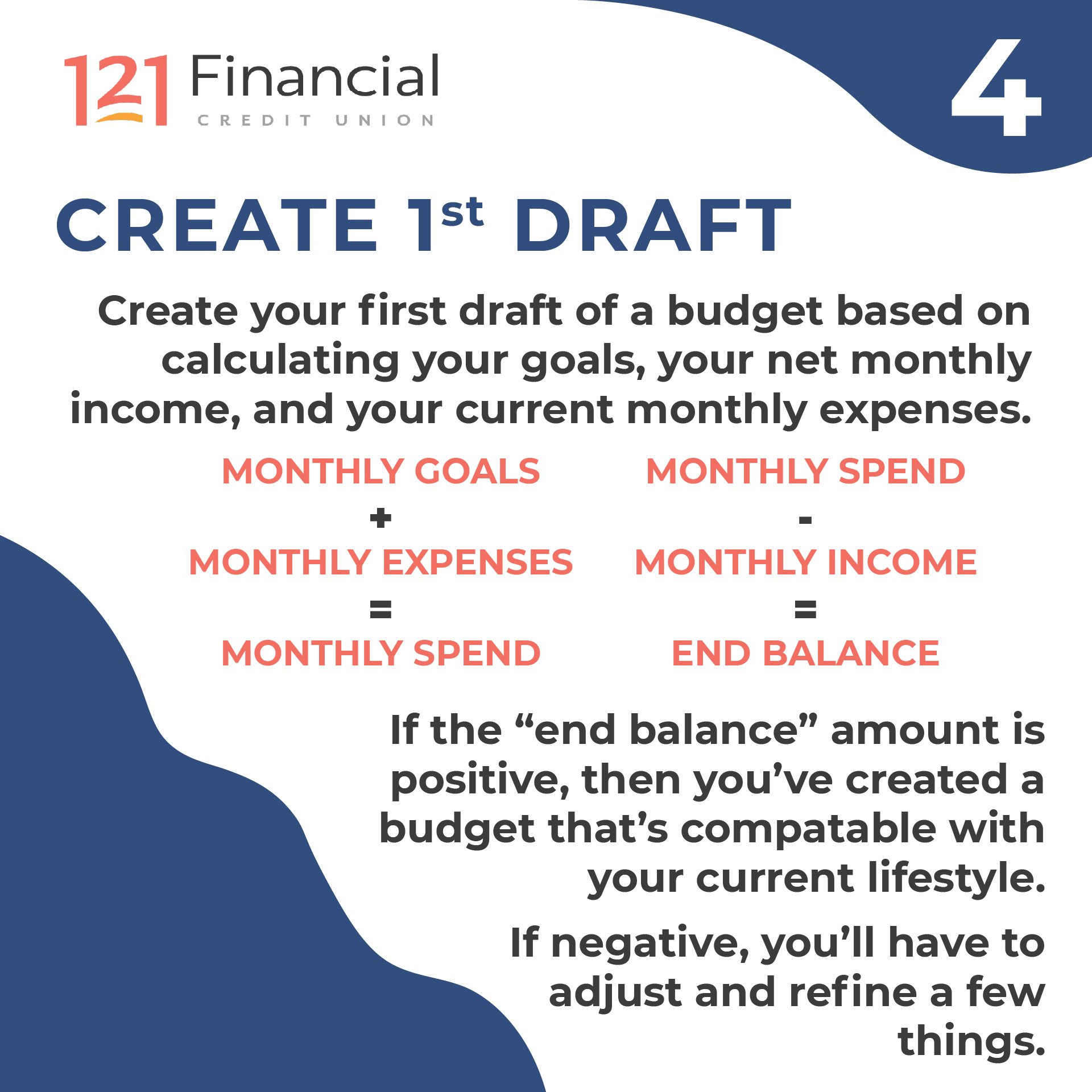

STEP 4: Create A Rough Draft of Your Budget

Now that there is a clear picture of your goals, the total net monthly income, and expenses of your household, it is time to build a basic budget. The formula for a basic budget is simple:

MONTHLY GOALS + MONTHLY EXPENSES = MONTHLY SPEND

MONTHLY SPEND – MONTHLY INCOME = END BALANCE

The ideal outcome is to have that end balance amount be positive. That is how one knows that they have created a budget that is compatible with their current lifestyle.

That positive balance can then be used for many purposes such as to pay off debt or save money. Save for something fun like a vacation or add the extra money to a retirement fund for the future.

However, if the end balance is negative, that means some things need to be adjusted.

Budgeting Methodologies

Numerous budgeting systems can be employed to make budgeting easier. What system is best for a specific household depends on what the overarching goal of that budget is and what your personal priorities are.

It is also important to consider how much time one is willing to spend on budgeting. Each system requires a certain amount of math and time devoted to it for success.

However, some require more than others and that should factor into the decision of which system to use.

50/30/20 System

If the household is operating relatively well and there are no specific needs to address with a budget, the 50/30/20 budget system is simple to implement and allows for plenty of room to cover current costs, pay down debt and save for the future.

Income is split three ways with 50 percent going towards needs, 30 percent for wants and 20 percent to debt repayment and/or savings. This method can also be used as a simple starting point in conjunction with another budgeting system.

Envelope System

If the goal of a budget is to curb spending, the envelope system is ideal. A cash-based approach, the envelope system helps to reduce frivolous spending and avoid debt without the need to track every penny spent.

As the name implies, this budgeting system utilizes envelopes for each of the household's expense categories identified in step three. A spending limit is established for each category based on the monthly spend established for that group. It can help to write that limit right on the envelope.

Each envelope is then filled with the allotted cash for that category and only that money is used for purchases. If the envelope is empty, there can be no more spending in that category until the next month.

The tactile nature of this system is part of what makes it work. People are hard-wired to see the physical as more real than numbers on a ledger or computer screen. In this way, cash truly is king.

Zero-Based System

Suitable for meticulous planners and overspenders alike, the zero-based budget system allows users to make the most of every dollar. Planners are encouraged to use every dollar of their monthly income in a deliberate way.

This method of budgeting allows spending to be monitored closely and requires a lot of attention. Each expense needs to be logged to ensure the budget stays on track. Several apps have popped up to aid with zero-based budgeting. EveryDollar and YNAB are two such apps.

Pay Yourself First System

This budgeting system is designed to align values and spending. The Pay Yourself First budgeting system puts savings before all other expenses. It is a simplistic system where the money for savings goals such as an emergency fund or retirement account is put ahead of bills and other expenses.

While this method of budgeting eliminates the need to crunch numbers like the zero-based system, it also carries the greatest risk of failure. The slightest miscalculation could leave a household without electricity or incur a late fee.

Mix and Match

The great thing about all of the systems named above is that you can combine them to make them work for you.

For example, maybe you use the zero-based budgeting system with the 50/30/20. You create three broad categories for your finances… but you also track every dollar to ensure you know where your money is being spent.

Whichever system or systems is utilized, the purpose remains the same; to cover all expenses and retain a positive end balance.

If the end balance is negative, there’s isn’t as large of a buffer for surprises, or there is no room for savings, this rough draft will need to be reworked and adjusted to create a final budget.

TIP: Personalize whatever system chosen to represent the individual needs of the household. There is no one-size-fits-all budgeting system. Let us know in the comments if you’ve found one not listed here that works for you!

Step 4 Recap:

STEP Five: Adjust & Rework Your Rough Draft into A Final Budget

When looking for places to trim the fat out of a budget that just doesn’t add up, consider what is a priority and what is not. It can be difficult to separate wants from needs at first.

Needs are generally those expenses that are required to live and work. Everything else can be considered a want and can be considered for the chopping block.

However, one person's want may be another's need... so these decisions need to be made on a situation by situation and person by person basis.

Adjust the numbers in your variable expense categories and see where money can be freed up with the least amount of disruption to your lifestyle.

Identify and Plug up those money Leaks

A money leak is simply any amount of money that you spent and quickly forgot about… or even overlooked. When reviewing your current expenses, you may have identified a few areas of concern or identified bad spending habits.

Did you possibly find that fees were eating a hole in your account or racking up your debt? Are you paying for services that you forgot you even still had? Does your Starbucks baristas start getting your “usual” ready as soon as they see you coming through the door?

Common avoidable and unnecessary spending areas to address and inspect immediately are:

- late fees on bills not paid on time

- not prioritizing paying off high interest credit cards

- overpaying on cell phone plans

- “ghost subscriptions” - forgotten auto-payments for things including magazines, gym memberships, streaming services, and more

- atm or bank fees

- overdraft fees

- phone bill fees or data overages

- dining out frequently

- ignoring free trial offer deadlines

- you don’t bundle your insurance policies

- you’re impulse shopping just because something is on sale

- frequent in-app or phone app purchases

Don’t Neglect to "Treat Yo’ Self"!

As stated above, wants can be reduced or even or cut out entirely— while needs obviously cannot. However, not everything allocated for "fun" should be cut out completely from a budget.

Keeping a budget enjoyable is the easiest way to ensure that it is realistic to your lifestyle as well as adhered to. This is such an important thing to remember. Even so, entertainment and extras should be the first place where cuts are made when a budget goes awry.

If you’re having trouble starting with this, it may be easier to break up your “wants" list into a hierarchy of priorities. Once you’ve engaged the emotional part of your brain by establishing your priorities, slashing expenses should be a lot easier.

You’ll also be able to see which are the most important to you and figure out how you can make room for them.

You may find out you don’t care at all about cable tv packages or designer clothing, for instance, but decide you do want to make room for a hobby or for travel.

After all, budgeting needs to be your way to achieve everything you want in life… not a dreaded chore.

Some easy ways to reduce costs and not feel as big of a dip in fun include:

- Have a home movie night rather than going to the theater

- Bundle services such as internet and cable television or consolidate streaming services for a lower monthly cost

- Work out at home rather than at the gym

- Switch your daily trips to see your favorite barista to weekly ones instead

Still No Wiggle room?

However, if these expense categories have no more wiggle room left and you’ve cut out as much as you’re realistically able to sacrifice, spending on needs or adjusting the specifics of your goals may need to be considered.

This will require a much greater level of discipline and might be highly disruptive to the household as it could involve a move to a cheaper residence or other extreme change.

TIP: Overestimating and rounding up expenses ensures that there is always enough to cover the bill when due. It also creates a little cushion in that expense category that can act as a tiny and flexible emergency fund.

Step 5 Recap:

STEP six: Implement & Track Your Budget

Once a budget is set up, your expenses need to be tracked in every category throughout the month, or ideally daily. This step helps to easily identify problematic spending patterns and unnecessary expenses while keeping overspending to a minimum.

While it only takes a few minutes each day to record expenses, tracking expenses is another one of the hardest parts of keeping up with a budget.

We know calculating receipts and categorizing your spending aren’t exactly everyone’s idea of a fun night in. However, there are apps and online tools available to help with this step of budgeting.

This step can be especially easy, and as close to effortless as possible, with tools and apps that integrate natively with your online financial accounts.

These sorts of free tools can be used to make every step of this process easier. Find one that can help with both budget creation as well as management for the best results.

Popular software apps for this that help with budget tracking include:

- Mint: This personal financial management website offers online services and an app for users in Canada as well as the United States. Mint is backed by financial giant Intuit, Inc who also produces Credit Karma, QuickBooks accounting software, and TurboTax. Mint's service allows users to create budgets, set financial goals and track expenses all through a single user interface. It provides direct integration with more than 16,000 financial institutions.

- Honeydue: This personal finance app for couples developed by WalletIQ, Inc. It provides access to investment and bank accounts at more than 20,000 financial institutions spread across 5 countries. Honeydue also offers bill reminder services that nudge users when it is time to pay so they can avoid any late payment penalties.

- Personal Capital: Personal Capital is a personal wealth management company and online financial advisor based in California with offices across the country. They offer budget tracking and financial planning tools that are available for free as well as advanced services for a fee. Users link their financial accounts to the service and can utilize an assortment of handy financial tools to access their financial standing.

How can I make it A Habit?

Just like starting a budget without a goal decreases your odds of success, inconsistency of tracking your progress and expenses can seriously derail you.

Rather than pairing the act of tracking and reviewing your expenses with a particular time and location, pair it with a current habit you have— even if it’s completely unrelated.

This is called habit stacking, or habit chaining, and the process involves grouping together small or multiple activities into a routine which you link to a habit already set in your day.

This makes the routine memorable and anchors your new habits to the existing one. The formula for this is:

"After/Before [CURRENT HABIT], I will [NEW HABIT]."

Try habit stacking in order to help create and build new budgeting habits. For example, “Before I brush my teeth in the evening, I will review and categorize my expenses from the day."

It’ll just be another part or your normal routine in no time.

Step 6 Recap:

STEP seven: Regularly Revisit & Refine Your Budget

Make an appointment with yourself to sit down with your budget and make sure it’s working for your current goals and realities. Circumstances change. Our priorities shift, we change jobs, we move, we have children. Your budget needs to work for you, not the other way around.

Weekly reviews of a budget help to keep it on track. This step allows areas of weakness to be found, progress towards goals to be gauged and spending limits to be evaluated.

Making small adjustments here and there as new information arises can help to keep the budget working well. If something is falling behind or simply not working out, go back to step five. Rework and adjust until the household budget seems to be running itself.

Do not forget to add in any new expenses that are incurred after the initial implementation of the budget. These will throw the budget off if they are forgotten.

Should I always stick with the same budget?

Life is constantly in motion and rarely stands still. What a household's lifestyle looks like today can change tomorrow. Budgets are living documents that must change and evolve as life does. Sometimes they need to be drastically overhauled.

The birth of a new baby, a marriage, a promotion at work and other life events can throw a well-crafted budget into complete turmoil. When something huge happens, it's time to throw that budget out and start over from step one.

This goes for the development of new goals as well. Any time a goal is reached, another goal should be set. After all, goal setting is the first step in budget creation.

Step 7 Recap:

A Few Final Thoughts On Creating a Budget

Keep in mind that no two households are the same and so their budgets should not be the same either. Comparing oneself to others is one of the surest ways to feel inadequate. Do not do it.

Whether written out by hand or done through an online app, budgeting is important for everyone and easier than most think. Establishing solid financial footing is the first step to a more secure and happy future.

Contact the financial experts at 121FCU for financial counseling. Members can receive free guidance on how to create a budget, pay off debt faster, or for any other financial services you need.