Secured vs Unsecured Credit Cards: Which One Should You Get?

A credit card can help you increase your spending power and quality of life, make ends meet during a financially difficult period and get you through an emergency, if you choose the right type of card and use it responsibly.

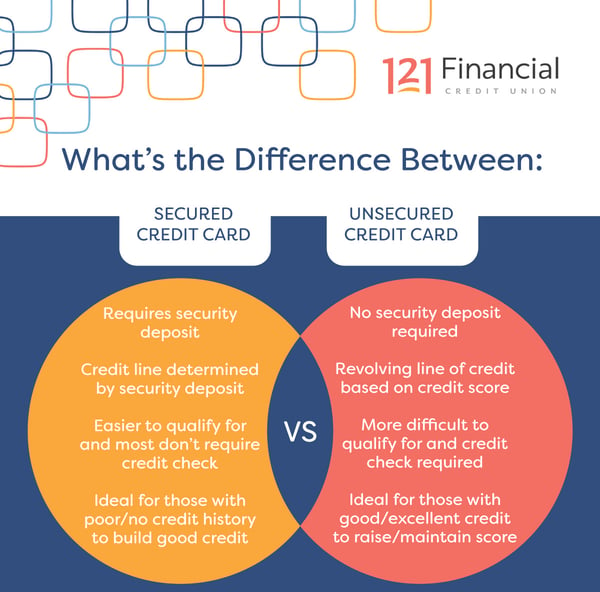

There are two basic types of credit cards: secured and unsecured. Each one offers its own benefits and drawbacks.

Knowing the right type of credit card to get can help you maintain, and even increase, your credit score. You can even use the right credit card to repair bad credit and get out of debt.

By the end of this article, you should have a much clearer idea of the key distinctions between secured vs unsecured credit cards and which of these two types of credit cards might be best for you to consider getting next.

Secured Credit Cards

What distinguishes a secured credit card from all other credit cards is that the available credit and credit limit are tied to an actual matching monetary balance called a security deposit that the cardholder deposits into a secure account, not unlike a bank account.

In other words, if you want to open a secured credit card account with a $500 credit limit, that would require you to provide a $500 security deposit.

That deposit is entirely refundable, provided your account remains in good standing, and is returned to you when you close your secured credit card or upgrade it to an unsecured one. In most cases, that deposit even earns interest at the current money market rate as it sits in your account.

If you withdrew money from that account, your credit limit and available credit would go down by the same amount. If you deposited more funds into the account, your credit limit and available credit would go up by that amount.

Benefits of Secured Credit Cards

One of the main benefits of a secured credit card is that you can get one with little-to-no credit history. You can even get one with poor credit.

Many secured credit card providers won't even check your credit before approving your application. They simply require a minimum deposit into your linked account and, if you make that, will provide you a secured credit card with a credit limit equal to the amount of that deposit.

Minimum security deposits vary from provider to provider, and even from secured card to secured card. You may need to deposit $500 to open a secured credit card account, or you could open one with a deposit as small as $49.

According to Finder, the typical security deposit required to open a secured credit card account is between $200 and $500.

Typically, you can increase your credit limit at any time by simply adding more to your security deposit. Likewise, you could withdraw funds from your security deposit, if you need the cash and your account is in good standing, and all that will happen is your credit limit will go down by that same amount.

Because you can get secured credit cards with bad credit or little-to-no credit, you can even use them to improve your credit. That's because secured credit card providers report to the credit bureaus just the same as unsecured credit card providers do.

As you demonstrate responsible cardholder behavior month after month, the provider of the secured credit card will report that behavior to the credit reporting agencies, which, in turn, reflect that on your credit history and score.

By making purchases on a secured card and paying the minimum monthly payments or greater on time, it can lead, one day, to you getting an unsecured credit card. After demonstrating responsible cardholder behavior over a sufficient length of time, the credit card provider may offer you a deal on an unsecured credit card.

Alternatively, when you feel you've sufficiently demonstrated your creditworthiness using your secured credit card, you can take the initiative and request the provider upgrade your card to an unsecured one.

Another benefit of secured credit cards is that missed payments are simply deducted from your security deposit, rather than added to your balance due earning interest. Of course, your credit limit is also subsequently decreased by that same amount.

Additionally, unlike many unsecured credit cards, secured credit cards have no annual fee.

Other than the key differences outlined above, secured credit cards operate almost exactly like unsecured credit cards.

Drawbacks of Secured Credit Cards

Secured credit cards do have their limitations and risks.

- Locked credit limit - One of the key limitations of secured credit cards is that your credit limit is locked to the amount of money you have deposited into the card's account.

- High interest rates - Another drawback of secured credit cards is that their interest rates are generally much higher than those for unsecured credit cards.

- No rewards - Secured credit cards also rarely come with rewards, such as travel miles, promotional APRs, balance transfer offers or cash back.

How to Get Upgraded From a Secured to an Unsecured Card

Once you have a secured credit card, you may make it a goal to eventually upgrade that card to an unsecured credit card. In order to qualify for such an upgrade:

- Make your monthly payments on time - Avoid making any late payments, as it's one of the offenses creditors dislike the most.

- If possible, pay off balances in their entirety - Avoiding carrying a balance, if you can, serves two benefits at once. It saves you money in interest charges, and it reflects better in your credit report and score.

- Don't max out your credit card - Using your secured credit card regularly allows you to show good cardholder behavior, but spending your credit limit even once, let alone repeatedly, makes you look like a spendthrift to lenders. Ideally, your credit utilization ratio, or the amount of your available credit that you actually spend at any given time, should be less than 30 percent.

Unsecured Credit Cards

When most people think of credit cards, they're thinking of unsecured credit cards. Any credit card commercial you see on tv or the internet or hear on the radio that doesn't explicitly indicate that it's advertising a secured credit card is almost certainly advertising an unsecured one.

When you apply for an unsecured credit card, the provider checks your credit to determine your creditworthiness and either denies your application or makes you an offer of a credit card with a specified credit limit and interest rate. You can, then, decide whether or not to accept that offer.

According to Cover Wallet, you need a credit score at least 550 in order to qualify for an unsecured credit card. If your credit score is above 680, you can even expect a competitive interest rate.

Benefits of an Unsecured Credit Card

Unlike secured credit cards, for unsecured credit cards, you do not need to put down a deposit to secure your credit balance. Instead, your credit limit, interest rate and eligibility for a credit card with a particular provider is tied exclusively to your own personal credit history.

This gives you the power to shop around and negotiate with credit card companies to find the best deal you can on a credit card. It's also why so many credit cards come with special promotional offers and rewards programs.

So, if you travel frequently, you may enjoy a credit card that offers you airline miles. If you carry one or more balances on other, higher-interest credit cards, you may appreciate a credit card with a balance transfer offer that includes a 0% promotional interest rate for a period of time.

Other rewards and promotions you may consider in an unsecured credit card include cash back rewards, shopping rewards and points rewards redeemable for gift cards.

Unsecured credit cards also offer one of the same main benefits secured credit cards offer, namely the ability to help you improve your credit score. Just like secured credit card providers regularly report cardholder behavior to the credit bureaus, so, too, do providers of unsecured credit cards.

Drawbacks of Unsecured Credit Cards

Unlike with a secured credit card, in which missed payments are simply deducted from your security deposit, with an unsecured credit card, all missed payments are added to your balance due, which accrues compounded interest charges the longer it remains unpaid.

Additionally, while unsecured credit cards do not require security deposits and generally have lower interest rates than secured credit cards, they often have annual fees.

How to Compare Unsecured Credit Cards

When comparing unsecured credit card offers, there are several criteria to consider, the most crucial being:

- The APR on purchases, balance transfers and cash advances

- Any rewards the card comes with, either as promotional introductory offers or ongoing rewards programs, ideally both

- Annual fees, late fees and hidden fees, like administrative fees

Once you know which unsecured credit cards you'd like to apply for, consider applying for them all within a short span of time to minimize the impact on your credit score.

You can either apply for multiple unsecured cards at once and see what kinds of offers you get approved for, or you can apply one at a time, starting with the card you want the most and working your way down the line as you get declined.

One benefit to applying for multiple cards before deciding which approval offer to accept is that you can see first how low of an APR and how high of a credit limit you can get from each one.

Secured vs Unsecured Credit Cards: Which One Is Right For You?

In summary, you may prefer a secured credit card if:

- You have poor credit or little-to-no credit.

- You want to improve your credit.

- You have a cash balance you can put down as a refundable deposit for the length of time that you keep the credit card account open.

- You understand and accept that the interest rate you'll pay on balances will be significantly higher than the prevailing rate for unsecured credit cards.

This makes secured credit cards ideal for students and other adults just starting out on their own.

That includes recently divorced individuals whose personal credit has been tied up with their ex-spouse's widowed individuals whose credit was intertwined with their departed spouse's until recently.

It also includes divorced and widowed folks whose former spouse handled all the finances and who, therefore, lack any credit of their own.

On the other hand, you may prefer an unsecured credit card if:

- You have a decent credit score.

- You want a competitive interest rate and as high a credit limit as possible.

- You don't want to put down a deposit to secure your credit limit.

- You want to participate in credit card rewards.

This makes unsecured credit cards ideal for people who've already established a credit history and are looking to expand or capitalize on that. Unsecured credit cards can be great for consolidating debt or meeting a major goal, like extending your education, taking a vacation, improving your home or starting a small business.

Regardless of which type of credit card you get, keep in mind that you'll likely need to sign a personal guarantee to receive it. This guarantee makes you personally liable for any outstanding debts and interest charges you accrue, should you default on payments.

Remember, as well, that all credit cards can be mismanaged and abused. Beware of using any kind of credit card irresponsibly, as you can stain your credit rather than improve it and wind yourself up in insurmountable, and mounting, debt.

If you're in Jacksonville, Florida or the surrounding northeast Florida area and you'd like to speak with a financial professional to discuss more your credit card options and what type of card may be right for you, contact us at (904) 723-6300 or visit us at 121 Financial Credit Union.