How Do Home Equity Loans Work? ...And When to Use Them

Home equity refers to the amount of money you've paid off on your home through your mortgage or home loan. You can get the amount of your home equity by taking the estimated market value of your home and subtracting whatever amount you owe on it. This is a very valuable asset, and you can use it to take out a home equity loan to repair or improve your property.

But how do home equity loans work? What can you miss out on if you're considering a loan for debt consolidation or to buy a new property, and you don't use it?

We want you to know all of your options, and we'll spell out exactly how home equity loans work, the types, how to calculate it, and much more. By the end, you'll know if this is a good option for you or if you should seek alternative options.

What is A Home Equity Loan?

A home equity loan can be simply defined as a loan for a fixed amount of money. Your home secures this loan, and you make equal monthly payments to repay it over a fixed period. The payments work just like your traditional mortgage payments-- which is why this type of loan is sometimes referred to as a second mortgage. If you default on your payments, the lender can start foreclosure proceedings on your home.

The amount you can borrow has a cap of 80% to 85% of your home's equity amount. However, things like your credit history, income, and your home's market value also play a role in the actual loan amount the lender approves you for.

How to Calculate Your Home Equity

Home equity is determined by subtracting the amount you still owe on your mortgage from the current market value of your home.

Calculating your home equity involves two steps. For this example, we're going to say that you purchased your house 10 years ago. Today, your home has a market value of $500,000. Your mortgage is at $300,000 since you've made your payments each month for the past 10 years. This means your home has built equity.

- Step One - The first thing you have to do is calculate out what 80% of your home's current value is. You do this by taking 0.80 and multiplying it by $500,000 to get your answer.

- Step Two - The answer is $400,000-- and you subtract this from your mortgage amount of $300,000. This gives you $100,000 as a total. This $100,000 is your home equity, and you can tap into it through a line of credit or a loan.

The Two Types of Home Equity Loans

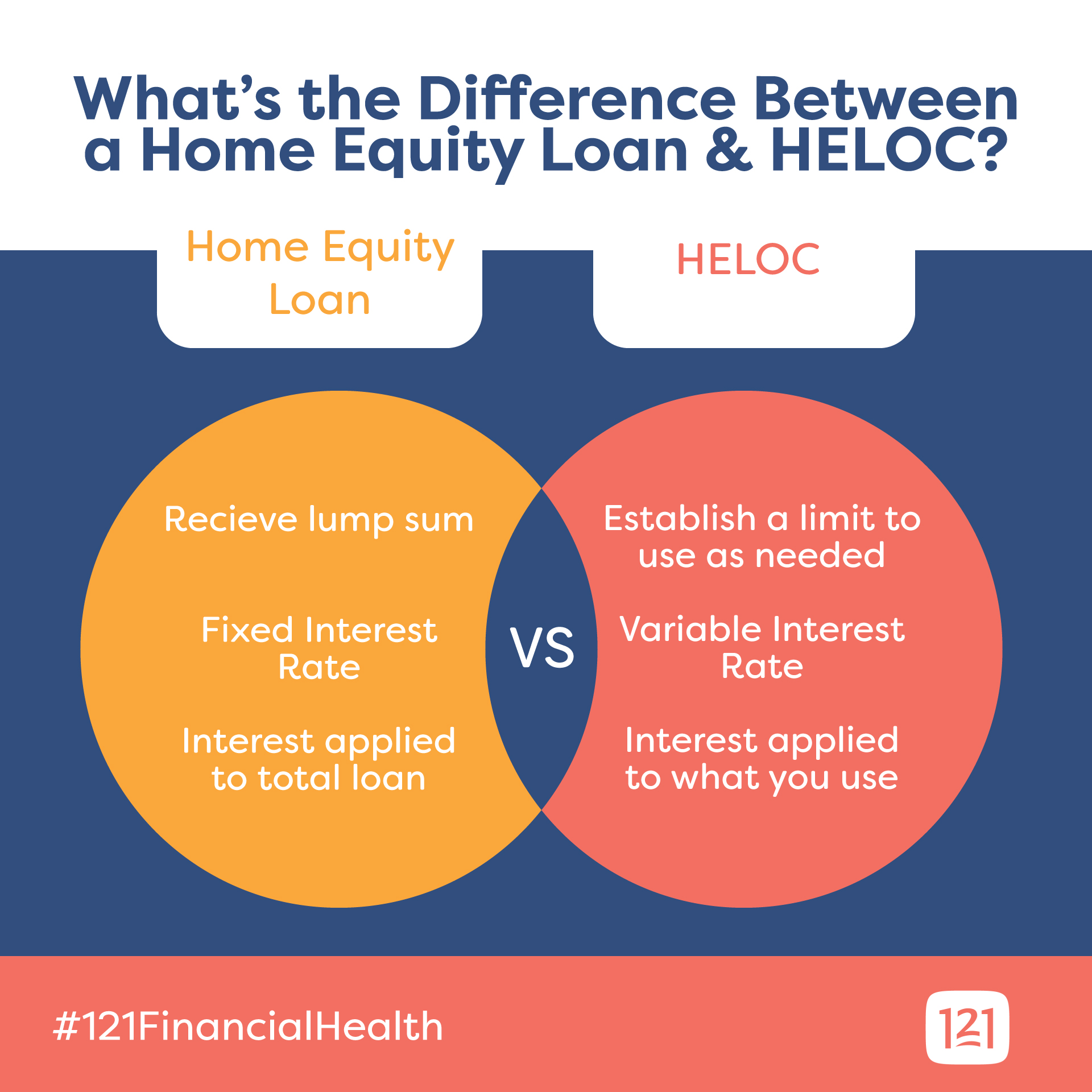

How do home equity loans work? Before we answer this question, you have to understand that there are two types of home equity you could apply for. Now that you know how to get your home equity amount, the next step is to understand your options. We listed the two types of home equity loans below.

1. Home Equity Loan

At its core, this is a second mortgage on your home. The lender pays you out in a lump sum. You're responsible for paying it back in monthly installments.

2. Home Equity Line of Credit (HELOC)

This is very similar to a traditional credit card. You'll have a limit on what you can borrow, and you pay the money back in monthly installments.

Defining a Second Mortgage

We mentioned that a home equity loan is a second mortgage, but what does that mean? This is a lien you take out on your home that already has a mortgage loan attached to it. A lien lays out specific circumstances in which the lender could seize or possess your property. If you default on your payments, the lender has the right to take control of your property. When you take out this second mortgage, the lien goes against the part of the property you already paid for by paying on your first mortgage.

Unlike many other types of loans, you can use your second mortgage's money to cover virtually anything from debt consolidation to repairs on the home and everything in between. Lenders who offer second mortgages usually have interest rates that come in at much lower levels than credit cards. In turn, many people use them to consolidate and pay off credit card debt.

Home Equity Loans

Since the home equity loan is a second mortgage, you use your property to secure your new debt. The lender pays you your total out as a lump sum when they approve you for this loan. Once you get it, you'll have to start repaying it straight away. You'll end up paying the amount plus a fixed interest rate. It'll be the same amount every month for the loan's term, and it could stretch from 5 to 15 years.

Home equity loans are popular choices for homeowners who have immediate, large expenses. It gives you the peace of mind that comes with knowing you're going to have predictable payment amounts, regardless of what the market does in terms of fluctuations. This allows you to plan and arrange your finances well in advance.

You make your monthly payments to your lender just like you did with your mortgage payments. They're due on the same date each month. Your terms can vary from lender to lender based on the amount you borrowed, your interest, and how much you can afford to pay each month. Traditionally, terms start at five years and go up to 15 and 20 years or over.

How to Qualify for a Home Equity Loan

There are a few minimum requirements you have to hit to qualify for your home equity loan. Each lender has its own set of rates and borrowing standards for their home equity loans, so it can be a good thing if you want to shop around before settling on one. You should also have a good idea of how much you want to borrow. Don't borrow more than you absolutely need to. We outlined the minimum requirements below.

- You have to have a minimum credit score of 620 and up. Having a credit score of 700 and up will help you secure the best rates.

- Your maximum loan-to-value ratio doesn't exceed 80%.

- You have a debt-to-income ratio of 43% to 50%.

- You know around how much you want to borrow and why.

- You have supporting documents that show the lender you can repay your new loan.

If you have a credit score that dips below 620, it can be very challenging for you to qualify for a home equity loan. Lenders will look at your debt-to-income ratio, credit score, financial documents, employment, and income to ensure you won't have a problem repaying your loan. You should have all of this together ahead of time.

Best Uses for a Home Equity Loan

One of the biggest uses for a home equity loan is for a large purchase. Maybe you want to update some parts of your home, or you have a lot of debt you have to take care of. Since they have lower interest rates, they're also popular for paying off credit card debt. It's much easier to manage a single payment with a fixed interest rate than it is to try and juggle multiple payments a month.

Home Equity Lines of Credit (HELOC)

The second option you have available is a home equity line of credit. Think of this as a credit card. It typically has an initial draw period of a decade from opening the card that allows you to pull out as much money as you need up to the credit line's limit. You'll make monthly payments to pay down your HELOC's principal balance. The credit will revolve and allow you to use it a second time. This is nice because you can pull money out as you need it.

You will pay a variable interest rate with this option, and this means that your monthly payments can fluctuate up and down over the lifetime of your loan. You can find lenders who will give you a fixed-rate home equity line of credit, but you should prepare yourself to pay a higher interest rate each month.

However, it gives you the flexibility to pay a combination of the principal balance and interest payments or interest-only payments. If you choose to pay on both the principal balance and the interest, you'll pay off your loan sooner. Once your draw period ends, whatever you have left for your interest and principal balance are due. The interest rate switches to a fixed one, and you usually have between 10 and 20 years to pay it in full.

How to Qualify for a HELOC

Just like with the home equity loan, the HELOC has a set of qualifications you have to meet in order for a lender to work with you. Again, they'll vary from lender to lender, and this is why shopping around is so important. You don't want to cheat yourself out of a good rate because you went with the first lender that offered. If you're a member of a Credit Union with good standing, you're more likely to be pre-qualified and approved with a chance at a lower APR. The basic qualification requirements are below.

- Ideally, you'll have a credit score of at least 680 or higher. There are lenders that work with people who have credit scores of 650, but you pay more in interest.

- Combined loan-to-value ratio. This is a core requirement. You get it by finding out the value of your home and dividing it by any other loan you have to secure your property and your remaining balance owed on the home.

- Your debt-to-income ratio should be no higher than 45%.

- You should have no history of bankruptcy or foreclosures.

- Employment length and monthly income

- Strong payment history with proof you can pay the line of credit.

The lower your credit score is, the less likely it is that a lender will take a chance and offer you a HELOC. If you do qualify at a lower credit score, you'll pay for it with much higher interest rates because the lender sees you as very high-risk for defaulting before you pay it in full.

Best Uses for HELOC

Since you usually get a 10 year draw period to pull funds whenever you need it, the HELOC is good for home repairs and renovations. You can renovate parts of your home to increase the overall value, or you can improve your home's appearance both inside and out. Adding more efficient features like new appliances or energy-saving lighting is a good use, and many people use this money to pay off their debt because it's easy to consolidate everything into one payment.

Home Equity Loans - Pros and Cons

Now that we've covered the basic concepts of home equity loans, we'll go over the pros and cons to make sure you're able to make the best decision for your situation. While these won't be deal-breakers for many people, it can help you make your final decision easier.

Home Equity Loan Pros

- Lower Borrowing Costs - Home equity loans usually have lower interest rates when you compare them to credit cards or personal loans because it uses your home as collateral to ensure you pay it back.

- Fixed Interest - Interest rates won't fluctuate depending on the market for the life of your loan. This makes planning your payments and arranging your finances easier.

- Money is Flexible - Instead of having a set area you can spend the money on, you can use it on whatever you like. It could finance a new business venture, fund an investment, pay for a vacation, or help you consolidate debt. There are no big restrictions to worry about when you get the money.

- Lump Sum Payment - The money the lender offers you is in a lump sum format. This makes it nice for those situations where you know exactly how much you need and what your intended purpose is. You could fund your kid's education, pay off debt, or improve your home.

Home Equity Loan Cons

- Risk Your Home - One of the biggest cons about home equity loans is that you risk your home. It is collateral for your loan, and the lender gets full rights to seize it if you fall behind on payments or default.

- Higher Interest - Your interest rate for your home equity loan will usually be higher than the interest attached to a HELOC. You're getting a fixed interest rate, but you'll pay more for the added stability.

- Fees and Costs - Getting a home equity loan usually means you'll pay fees and closing costs. You could be able to add these to your total loan amount, but you do want to keep them in mind when you start to shop for different lenders because they'll fluctuate.

Alternatives to Home Equity Loans

If you don't qualify for either of these options or you don't want to risk your home, there are alternatives available to you. Two main ones come to mind, and they both have their own pros and cons associated with them.

Cash-Out Refinance

Unlike a second mortgage that you pay on top of your existing mortgage with a home equity loan, a cash-out refinance of your home replaces your current mortgage. It increases the total you owe up over your home's actual value. This is the portion of the money that you can cash out. Once you do, you can spend it on whatever you need with no restrictions.

Personal Loans

The second option is a personal loan. Credit Unions, banks, and online lenders all offer them for various amounts. They'll typically be less than what the other options offer, but they can be more flexible with the borrowing requirements. You can use the money for anything, and they have a fixed and flexible interest.

How Home Equity Loans Work: A Recap

Those are the basics of how home equity loans work. Are you ready to learn more about a home equity loan or a HELOC? If so, reach out and get in touch. Our staff is ready to guide you through the process and help you get the funding you need. Be sure to check out our HELOC service page and use our HELOC Payment Calculator!

Are you still confused or undecided on wether this type of loan is the right move for your current financial situation? 121FCU members receive FREE financial counseling and guidance.