How Does a Mortgage Work: A Guide for First-Time Homebuyers

In that way, a mortgage can be the key you need to finally unlock the door of home ownership.

In this guide, you’ll learn what a mortgage is and how does a mortgage work, including:

- The parties involved in a mortgage

- The key parts of a mortgage

- How a mortgage gets paid off

You’ll also learn:

- The various types of mortgages

- The pros and cons of taking out a mortgage

- The consequences of not paying your mortgage

- The step-by-step process of getting a mortgage

Without a mortgage, you’d have to pay for a home in cash, which, for most people, is just not possible.

With the wrong mortgage, you could pay way too much for the home in interest and fees and outsized payments. And when that happens, you may eventually find yourself unable to make your payments consistently and on time and, ultimately, lose your home.

That's why this guide aims to empower you to choose the best type of mortgage for you and your needs, so that you can experience all the joys of home ownership with confidence, comfort and peace of mind.

What Is a Mortgage?

The term "mortgage" is often used as an all-encompassing term for a loan for a home or piece of property. In a mortgage, the lender (such as a credit union or bank) agrees to loan the borrower (such as you) the funds to purchase a particular piece of property, and the borrower agrees to pay back that loan in incremental installments over time, typically with interest.

Therefore, in the simplest terms and the way you will most commonly see it used, a mortgage is a loan for a home or other piece of property and the legal agreement between the borrower and lender setting out the details of that loan.

In truth, a loan for a home or piece of property is made up of several parts (see below,) just one of which is the actual mortgage.

During the life of the loan, the lender retains actual ownership of the property. If the borrower defaults on the loan agreement, such as by not making the agreed-upon payments, the lender can choose to terminate the loan agreement and take possession of the property through the process of foreclosure.

Once the lender has taken possession of a property after the borrower defaults on the mortgage for that property, the lender is free to sell (or rent) that property to anyone else it chooses.

Parties Involved in a Mortgage

A mortgage typically has two main parties:

- The mortgagee or the lender (ie. the bank or credit union)

- The mortgagor or the borrower (ie. you)

In some cases, a third party, known as a trustee, may be involved. A trustee holds the property being purchased in trust until the mortgage loan is completely paid off. Most commonly, this is a title company.

The mortgage document lays out the specific rights and responsibilities of each party regarding the home and home loan.

Important Parts of a Mortgage

There are several components making up a mortgage, as follows:

Promissory Note - This is a document that details how you will pay back the loan. It typically includes, among other possible details:

- The name of the borrower

- The name of the lender

- The address of the property

- The amount of the loan - Typically the purchase price of the property minus any downpayment the lender requires to secure the loan

- The amount of the deposit and downpayment required to guarantee the loan

- The interest rate on the loan

- The Annual Percentage Rate (APR) which also includes fees and other charges (see more on this below)

- All other fees associated with the loan

- The collateral for the loan - Typically the property itself

- The repayment terms - Including the exact monthly payment and the day of the month by which it’s due

- Penalties for missed payments

Mortgage - As explained above, the actual mortgage document establishes the home or property being purchased with the funds being borrowed as collateral for the loan. If the borrower defaults on the loan, the mortgage lays out the terms and conditions by which the lender can take possession of the property or home.

Deed of Trust - This document may or may not be a part of a given mortgage. If it is included, it identifies a third party besides the lender and borrower to act as a trustee for the loan.

The deed of trust acts as security for the promissory note, protecting the lender from the borrower's failure to pay according to the terms of the note.

Note that a deed of trust is not the same thing as the deed to a property, which conveys ownership of the property from one party to another.

Loan Costs

When you take out a mortgage to buy a home or other property, you will be paying more for that property by the time you pay off the loan than the actual purchase price of the property.

How Interest is Determined

Lenders consider several factors in determining the interest rate to charge a borrower on a mortgage, most notably:

- The current market rate for the type of loan the borrower is getting - This factor is purely a matter of timing.

- The borrower’s credit score - The higher your credit score, the lower your potential interest rate.

- The amount of money being loaned - The larger the downpayment you can afford to pay, the lower your potential interest rate.

- How many mortgage discount points you buy (if any) - By paying a fixed fee up front, you can avoid having to pay borrow as much, and therefore pay as much in interest.

- Whether the loan is fixed-rate or variable-rate loan - As mentioned above, the initial interest rate on a variable-rate loan may be lower than the one for a fixed-rate loan, but it can go higher than that fixed rate any time the variable rate adjusts.

- In what state the property is located

- What type of loan you get (more on this below)

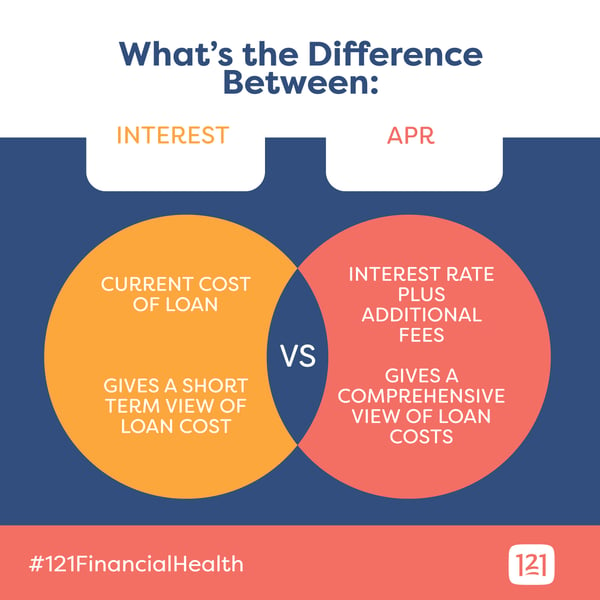

Interest vs. APR

The interest rate, or simple interest, is a percentage of the total loan that the borrower agrees to pay in installments as one of the main costs of the loan.

Most home mortgages are simple interest loans, meaning that the interest rate does not compound during the loan term. That is, the unpaid interest is not added to the principal remaining on the loan, thereby accruing additional interest, but rather predetermined at the loan’s outset.

The APR (Annual Percentage Rate) is the full amount you will pay for the loan above and beyond the principal on the loan. It includes the simple interest rate as well as other costs and fees.

- Discount points

- Mortgage origination fees

- Mortgage broker fees

- Every other cost related to the financing of the loan other than the actual purchase price of the home

Escrow

Other charges that may be added to your monthly payment besides your APR include taxes and insurance.

Taxes you may need to pay include property taxes. Insurance you may need (or choose) to hold for your mortgage include private mortgage insurance (or PMI), which protects the lender in case you default on payment, and homeowner’s insurance.

In order to help you cover these extra costs incrementally over time rather than all at once, you may choose (or, in cases, be required) to include an escrow agreement in your mortgage.

The borrower agrees to pay a certain amount extra in his or her monthly payment to be placed in that escrow account on behalf of the borrower to be used explicitly to pay those taxes and insurance costs.

If a mortgage includes an escrow agreement, this amount will be included in the monthly payment and detailed in the breakdown of how that payment is applied each month, typically as follows:

- Principal (or the actual loan amount itself)

- Interest

- Escrow

- Fees (including mortgage broker and origination fees and any cost for discount points, among others)

How a Mortgage Gets Paid Off

When looking at how does a mortgage work, one of the most important factors to understand is how a mortgage is paid off.

Typically, a borrower will make monthly payments to the lender of equal installments by the same due date of every month. This monthly payment will be apportioned off according to the loan agreement into payments of principal and interest.

Amortization

In most mortgage agreements, the monthly payments are amortized. That means each payment is applied to interest first and, then, to principal, and as the interest is paid down, the portion of the payment applied to principal rather than interest gradually increases.

Some mortgages, however, are interest-only loans, in which all of your monthly payments are applied toward interest until it is paid off completely. Only then do your monthly payments start paying down principal.

Additional Payments

A borrower can generally make additional payments toward his or her mortgage at any time, and, depending on the terms of the mortgage agreement, they may even be able to determine how to apply it: toward principal, interest or some combination thereof.

Pre-payments

Also in some mortgages, but not all, a borrower can prepay the entire loan amount (with or without penalty) and avoid having to pay all the interest that would accrue were the borrower to take the full loan term to pay back the loan.

Know Before You Sign

The only way to know what you can and can’t do in paying back your loan, including determining how additional payments are apportioned and prepaying without penalty, is to read carefully the terms of your loan before you sign on the dotted line.

Also remember that you always have the power of negotiation. If you find a desired term missing from your agreement or a term you don’t like, it’s well worth seeing if you can’t negotiate a way around that with the lender.

Types of Mortgages

There are several types of mortgages to choose from, each with its own advantages for different borrowers, depending on their particular situation. There are several factors determining the various types of mortgages, most notably:

- Term - How long the borrower has to pay back the loan

- Rate - The interest the borrower will pay on the loan

- Source - The affiliation of the lender (ie. private or “public”)

Below, you’ll find more details on each of these.

Short Term vs. Long Term

Payments on a mortgage can be spread out over any length of time, or mortgage term. The most common is the 30-year mortgage, but you’ll often see 20, 15, and even 10-year mortgages.

On the flip side, you can also find mortgages with longer terms than the standard 30 years, among the most common being the 40-year mortgage.

The term you choose for your mortgage has advantages and disadvantages to be aware of. All else being equal:

- The shorter the term, the less you pay overall in interest over the life of the loan, but the larger the monthly payments.

- The longer the term, the smaller your monthly payments, but the more you’ll pay in interest over the life of the loan.

Fixed Rate vs. Variable Rate

Fixed Rate - A fixed rate, just as it sounds, remains the same over the entire term of the loan. If you take out a fixed-rate mortgage with a 4% interest rate, that interest rate will stay at 4% until you pay off the loan.

Variable Rate - A variable rate changes, or can change, based on terms laid out in the loan agreement. Generally, the rate is reassessed on a regular schedule based on a selected market rate, like the interest rate at the time on the 30-year treasury note, and, if necessary, recalculated accordingly.

The benefit of a variable-rate mortgage over a fixed-rate mortgage is that your interest rate can lower in times of lower market rates, allowing you to benefit from lower rates.

The drawback of a variable-rate mortgage over a fixed-rate mortgage is that your interest rate can rise at any time during the loan term, forcing you to pay more in interest charges and possibly make larger payments. This can create sudden chaos with a household’s budget and cause a homeowner to risk defaulting on the loan.

Adjustable Rate - An adjustable rate mortgage, or ARM, is similar to a variable rate mortgage in that the interest can change periodically over the life of the loan. In an arm, the initial interest rate remains fixed for a set term before it is adjusted.

This fixed initial term can be of any length, most commonly 1, 3, 5, 7, or 10 years. After that fixed term, the rate can change every year based on the market rate indicated in the mortgage document.

The benefits and drawbacks of ARMs over fixed-rate mortgages are the same as those of variable-rate mortgages over fixed-rate mortgages. In addition, the initial rate on an ARM is generally lower than the standard fixed rate available at the time, but that rate can increase well above that fixed rate over time, depending on market conditions.

The benefit of an ARM over a variable-rate mortgage is that you start out with a fixed rate for a set term, enabling you to get into a home quicker and more affordably, giving you some time to settle in before your interest charges (and possibly payment amount) increase.

Most ARMs have a maximum interest rate the loan can reach.

Conventional Loans vs. Government Loans

Conventional Loan - Loans issued by banks and other private lenders are considered conventional loans. Conventional loans are beholden to loan limits established by Freddie Mac and Fannie Mae. These are government-sponsored enterprises (GSEs) that buy and sell mortgage-backed securities.

Conventional loans are best for borrowers with stable incomes and higher credit scores.

Government Loan - Loans issued by government bodies like the:

- Federal Housing Administration (FHA) - For first-time homebuyers and low-income individuals

- United States Department of Agriculture (USDA) - For borrowers in rural locales able to meet certain income requirements.

- Veterans Administration (VA.) - For military-service members

Conforming Loans vs. Jumbo Loans

Conforming Loans - Fannie Mae and Freddie Mac set certain loan limits by which conventional lenders must abide. If you take out a mortgage that falls within GSE maximum loan limits and complies with its underwriting guidelines, it is considered a conforming loan.

Jumbo Loans - If you need to borrow more money than a conventional loan permits, you may be able to take out a jumbo loan. Since these represent a higher risk for their lenders, they typically have higher eligibility requirements and costs.

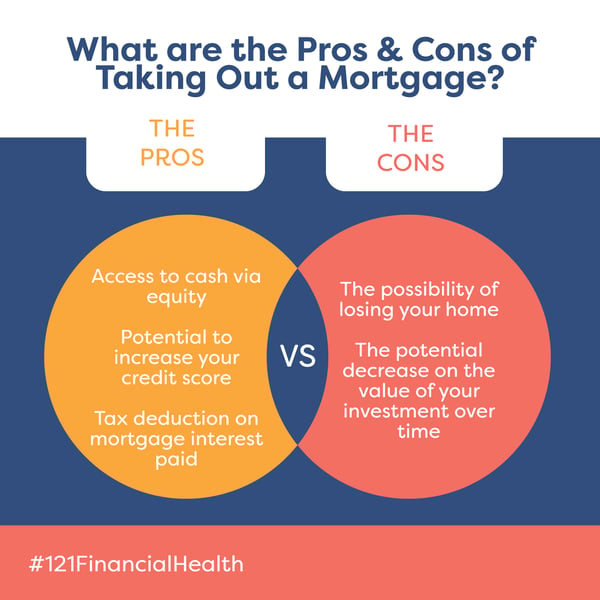

The Pros & Cons of Taking Out a Mortgage

These are the main pros of taking out a mortgage:

- The pride and security of home ownership

- Access to cash via equity

- Potential to increase your credit score

- Tax deduction on mortgage interest paid

These are the main cons of taking out a mortgage:

- The possibility of losing your home

- The potential decrease on the value of your investment over time

Consequences of Not Paying Your Mortgage

If you fail to pay your monthly mortgage payments on time, your lender can report the lateness to the credit reporting agencies, lowering your credit score. You can also be charged a late fee and accrue additional interest.

If you default on your mortgage by failing to even make late payments, your lender could foreclose on the home. When this occurs, not only do you lose your home, but your credit score takes a huge hit, and it can become much harder afterward to get another mortgage on a future property.

Qualifying for a Mortgage

Every lender has different standards for determining whether to approve a mortgage application and under what terms. In general, those standards involve several common criteria, namely:

- Your credit score

- Your income

- Your debt-to-income ratio

- Any history of foreclosure or bankruptcy

- Amount of downpayment you can agree to pay

If you are unable to qualify for a mortgage on your own based on your credit score, income and credit history, you may be able to qualify by having someone else co-sign the loan for you.

A co-signer on a mortgage shares the responsibility for the loan equally with the primary borrower.

How Does A Mortgage Work: Step-by-Step Guide

1. Preparation

Before you begin the mortgage process:

- Check your credit score to get an idea of your eligibility - If you feel your credit score is too low to qualify for the mortgage or terms you’re looking for, take some steps to improve your credit score before you try to prequalify.

- Collect your income information - When you apply for a mortgage, you’ll need to list your exact income and provide acceptable documentation proving it.

- Pay your bills on time and get current with any outstanding bills - This will help you increase your credit score before lenders check it to determine your creditworthiness for a mortgage at desirable rates and terms.

- Avoid changing jobs right before planning to apply for mortgages - Lenders look for stability in an applicant, and recent job changes could suggest its opposite.

- Research the type of loan solution best for your needs - Speak with a mortgage expert near you for guidance.

- Evaluate your current budget to figure out how much of a mortgage you can actually afford - You have a much better chance of being approved for a mortgage within your means than one that stretches or exceeds those means.

2. Pre-qualification and/or Pre-approval

Not every borrower tries to get prequalified and pre-approved for a mortgage, but attempting at least one of these can give you a good idea of your prospects moving forward.

In both pre-qualification and pre-approval, the lender assesses your creditworthiness and decides whether or not to make you an offer contingent on your ability to prove the information on which that offer was based.

The difference between the two is that, in a preapproval, the lender commits to approving your for the loan provided you can indeed verify all the information used to make that decision, whereas, in a prequalification, the lender makes no such promises.

Not only does pre-qualification and pre-approval give you the confidence to move forward with finding the home or property you wish to buy, if you haven’t already. It also gives you potential leverage with other lenders to try and get a better loan with more advantageous terms for you.

The underwriter who evaluates your application for pre-qualification or pre-approval can give you one of several responses:

- Approval

- Approval with conditions

- Suspended pending additional documentation required from the borrower

- Denied

3. Lock in Rate and Terms

Once you and a lender have come up with an offer acceptable to you both, it’s time to lock in that deal before it’s no longer available. Unless you do this, your lender can change the rate and terms of the offer at any time.

Locking in the rate and terms of a mortgage offer commits the lender to fulfilling that offer. Typically, you must pay a deposit of an amount set by the lender in order to lock in that offer.

When you lock in the rate and terms of a mortgage offer, the lender typically dictates a deadline by which you must finalize your loan. If you do not finalize your loan before this deadline, the terms and conditions of the original offer are no longer locked and can be changed by the lender at any time, or the offer withdrawn entirely.

Once you have locked in the rate and terms of your mortgage, you are free to make an offer on the home or property you wish to purchase.

4. Close

Closing on a mortgage is simply “closing the deal” or signing on the dotted line. When you close on your mortgage, that means the money from the lender is transferred to the property seller on your behalf, and the deed for the property is conveyed from the seller to you, the buyer, and the borrower.

In order to close on your mortgage, you must fulfill all the conditions set by the loan’s underwriter. The underwriter will provide you with a checklist of all these conditions, which may include (but are not limited to):

- Requests for additional supplementary or alternative documentation

- Corrections or explanations of anomalies

- Attestations and verifications, such as employment history, income, gift funds and housing or rental history

Wrapping Up

In this guide, you learned the answer to the question, "How does a mortgage work?" and that a mortgage is a document formalizing a loan to purchase a property or home.

You learned it involves a borrower and a lender and includes specific details like the interest and fees charged for the loan and the term and payment schedule.

You also learned the various types of mortgage available, including short-term and long-term, fixed-rate and variable-rate, from conventional and government lenders, along with the pros and cons of each.

You learned as well how to qualify for a mortgage with your income, credit score and history and, if necessary, a co-signer.

Armed with this information, you’re ready to pursue the mortgage you need to buy that home or property you want. The next step is to talk with a mortgage professional to discuss your needs and the options available.

You can find mortgage experts who specialize in the Jacksonville, Florida area at your disposal at 121 Financial Credit Union. Call today or take a look at our mortgage loans to get started on your journey to property or home ownership.