How Do Money Market Accounts Work vs Savings Accounts?

Published by 121FCU on

Feb 26, 2020 11:40:27 AM

If you’ve ever found yourself wondering "How do money market accounts work", you’re not alone. It’s understandable why you’d feel a bit confused. Most of us are taught the basics about checking and savings accounts because they are two of the most common types of banking accounts.

Money market accounts seem different than those two familiar account types, mostly because we aren't learning about them as often from a young age when we learn about personal finances. However, the truth is if you’ve used a checking and a savings account, then you already have a basic understanding of what a money market account is, probably without realizing it. Here’s what you need to know.

In order to answer this question, it would be good to do a basic review. This will allow you to re-familiarize yourself with the basics of checking versus savings accounts. Once you know the basics of each of these accounts, you’ll see how money market accounts are similar... and how they are different.

What Is a Money Market Account?

In order to answer this question, it would be good to do a basic review. This will allow you to re-familiarize yourself with the basics of checking versus savings accounts. Once you know the basics of each of these accounts, you’ll see how money market accounts are similar... and how they are different.

What Is a Savings Account?

A savings account, also known as a Share Account at Credit Unions, is a deposit account. This account pays a small amount of interest on your deposits each month. Most people open savings accounts to save up for cars, vacations and for rainy days.

This type of account is good to store your emergency fund in because it is relatively easy to withdraw money from it if you need to. That said, federal law says you can only make six withdrawals from your savings account each month.

However, you’re usually not restricted on the amount of money you can take from your account when you do withdraw from it, provided you have enough money to cover your withdrawal request. You’re not limited in the number of deposits you can make, either.

What Is a Checking Account?

A checking account is an account that is offered by a credit union or bank and allows you to withdraw money from the account on a regular basis. You can do so by writing checks, transferring the money electronically, by using your debit card, or by withdrawing money out of the ATM.

Many financial institutions will pay some interest on checking accounts, however the rates for checking accounts are usually the lowest APY.

Unlike the savings account, you are not limited on the number of deposits or withdrawals you can make.

What Is a Money Market Account?

Basically, a money market account is a deposit account that combines some of the features of a checking account with some of the features of a savings account. A money market account allows you to write a limited number of checks on what is basically a savings account.

However, a money market account pays a higher interest rate than many checking or savings accounts do. The flip side is that much of the time, the minimum deposit required to open the account is much higher than it would be for a savings account or even some checking accounts.

For example, some money market accounts require $10,000 up front to open them. Some financial institutions will also charge you a fee if you dip below the required minimum amount.

Account Safety

Just like checking and savings accounts, money market accounts are federally insured for up to $250,000 for a single account holder and $500,000 for joint account holders. The National Credit Union Administration says that:

the National Credit Union Share Insurance Fund was created by Congress in 1970 to insure member’s deposits in federally insured credit unions. Administered by the NCUA, the Share Insurance Fund insures individual accounts up to $250,000, and a member’s interest in all joint accounts combined is insured up to $250,000.

Are Money Market Funds Similar?

Many people confuse money market accounts with money market funds, which are a type of mutual funds offered by investment firms. These are not deposit accounts and are not federally protected or insured.

How Do Money Market Accounts Work differently From Checking or Savings?

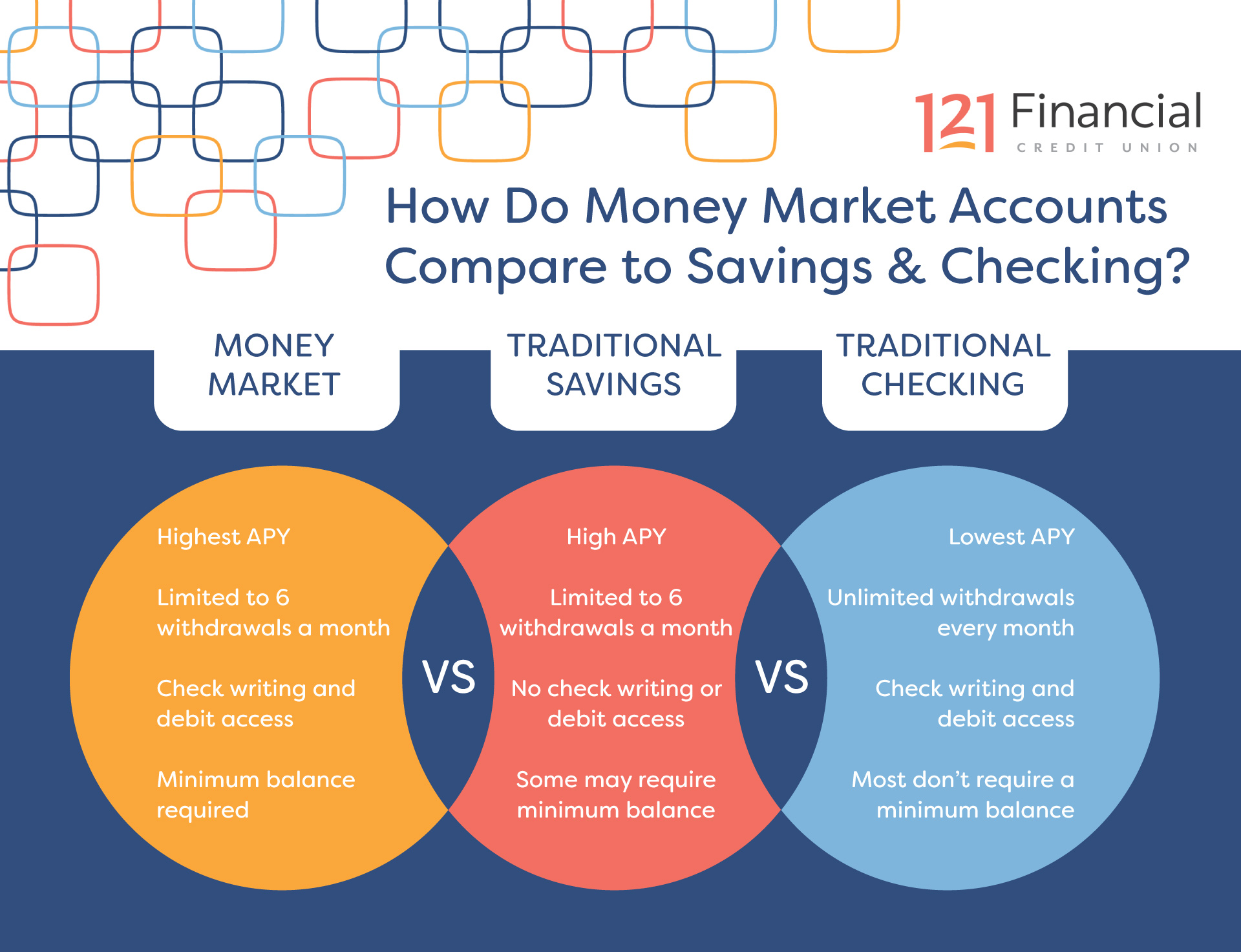

A money market account differs from a checking account in that you have a limited number of withdrawals and transfers that you can make within a single month or account cycle. The limit is six-- similar to the amount you can withdraw without penalties from a savings account.

Checking accounts allow you to write as many checks as many times per month as you want to: The same goes for ATM use, money transfers, and other similar account activities.

Money market accounts are different from savings accounts in that you have check-writing privileges, which don’t come with a savings account. However, since most money market accounts earn a higher interest rate than the average checking account, you basically get check-writing privileges with a better interest rate.

Using Money Market Vs Savings Accounts or Checking Accounts

Often the question of which to use when boils down to the interest rates and cash availability. One of the advantages of savings accounts is that they are liquid enough to allow you to withdraw cash when you need to. They’re good for short-term savings goals, like emergency funds or yearly vacations.

Money Market Interest Rates

However, it’s the money market account’s interest rates that make them so attractive for medium-range goals, like college savings. Typically, money market accounts pay higher interest rates than both checking and savings accounts: Some of them will pay almost 3% interest, though the required minimum on these tends to be very high. In this respect, money market accounts pay as much in interest as some certificates of deposit (CDs), without the withdrawal penalties.

The downside to all of these types of accounts is that compared to some mutual funds and other investments, the interest rate is low. It doesn’t keep up with inflation. Truth be told, modern investors need many different types of accounts in order to reach their financial goals.

The best investors have accounts for their short-term, medium-term and long-term goals.

Also the money market account’s check-writing restrictions also make it less attractive to people who do need to have more access to their money for bills, living expenses, and other ongoing things. That’s where checking accounts have the advantage.

Money Market Eligibility and Requirements

As we already mentioned, most money market accounts come with a required minimum balance. It’s possible to find some money market accounts that allow you to open them for as little as $500. 121FCU Money Market Accounts offer extremely competitive interest rates and very low minimum balance requirements.

Some of the money market accounts that offer the most in interest often also require a deposit of $20,000 or more. They also require that you keep at least that amount in them at all times (if you don’t want to get penalized for going below the amount).

That being the case, you must also be prepared to keep at least the minimum amount in the account and additionally be willing to limit your usage to six transactions or fewer each market cycle.

Tempted to Dip into Your Savings?

Some of the requirements for a money market account are also personal, meaning that if you’re going to keep a large sum of money in it, you must also be willing to leave it alone for the most part. This will take discipline. If you don’t feel you have it, at least not at first, you may be better off with a CD, or Certificates of Deposit.

These type of accounts typically offer very high fixed interest rates and have a fixed date of withdrawal, known as the maturity date. There are more penalty fees for withdrawing your money before the CD matures, which gives you a greater incentive not to touch your money.

Money Market Tips for Beginners

First Steps

If the minimum deposit requirement is the biggest hurdle for you to open a money market account, then the first step is to start saving money in a traditional savings account. This needs to be done until enough money is saved to open a money market account.

Do Your Research!

While you are waiting to save enough money to fully take advantage of a higher interest rate money market account, you can spend your time researching the different money market accounts on the market.

This research will give you the opportunity to weigh the pros and cons of each of the money market accounts you’re considering. The reason you would shop around is if the interest rate your current bank offers isn’t competitive enough for your goals.

By the time you do have enough money to put into your money market account, you’ll have a pretty good idea where to put your money. You will have read reviews of different companies that offer them and view their interest rates and terms.

By the time you do have enough money to put into your money market account, you’ll have a pretty good idea where to put your money. You will have read reviews of different companies that offer them and view their interest rates and terms.

You’ll also know which financial institutions will charge you to open an account. Some accounts will be free. Some will cost, like the standard checking accounts in many banks.

During your savings period before you get your MMA, you’ll interact with your bank or credit union a lot. You’ll get an idea of whether or not you prefer dealing with your bankers primarily face-to-face or if you prefer online banking. This experience can also help you narrow down your choices for your money market accounts home.

During your savings period before you get your MMA, you’ll interact with your bank or credit union a lot. You’ll get an idea of whether or not you prefer dealing with your bankers primarily face-to-face or if you prefer online banking. This experience can also help you narrow down your choices for your money market accounts home.

How Do Money Market Accounts Work: Final Words

Money market accounts offer their users so many advantages. They give users access to the best features of both checking and savings accounts in one account. MMAs typically offer interest rates that rival those found in certificates of deposit (CDs), but come with fewer withdrawal penalties.

Higher Minimums = Higher Interest RatesLower Minimums = Lower Interest Rates

They do have a minimum deposit, meaning that you cannot open one until you have met the required minimum. While some accounts only require $500 or so, many require thousands of dollars to be deposited. The advantage to the ones with the higher minimum amounts is that they typically pay better interest rates than the ones with smaller minimum amounts.

Most people use these accounts to save for medium-range goals, like education or a down payment on a house. The features of these accounts also mean that once you reach your savings goal, it’s possible to write a check to pay the down payment or tuition bill directly from the account.

Most people use these accounts to save for medium-range goals, like education or a down payment on a house. The features of these accounts also mean that once you reach your savings goal, it’s possible to write a check to pay the down payment or tuition bill directly from the account.

Why Would I Need So Many Different Accounts?

When to use which account really boils down to need. Most people who have some financial savvy know that the best financial defense includes lots of different kinds of accounts.

Each account plays a role. One account, like a checking account, may pay all the monthly bills or for dinner and entertainment. The savings account will be the place for an emergency fund. It may also be where the savings for a money market account starts.

What are Your Savings Goals?

Finally, money market accounts, CDs, savings bonds, and even mutual funds work best for medium-range to long-range savings goals. These accounts allow you to save money for a child’s education or for your retirement. Keeping each of these accounts separate allows you to allocate the right amount of money where you need it... and when you need it.

Have more questions? Financial counseling is FREE for 121FCU Members and even from the comfort of your own home!

Tags:

Savings & Investments